Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.

Por um escritor misterioso

Last updated 29 março 2025

What Are Pre-Tax Deductions?

How Long Does It Take For Everyday Payroll To Process?

Real-Time Poverty, Material Well-Being, and the Child Tax Credit

Document 4 - Dania Beach e-forms

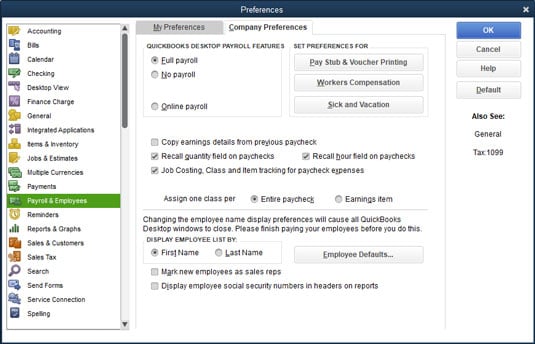

payroll software - FasterCapital

Can you request payroll stubs from a previous employer? - Quora

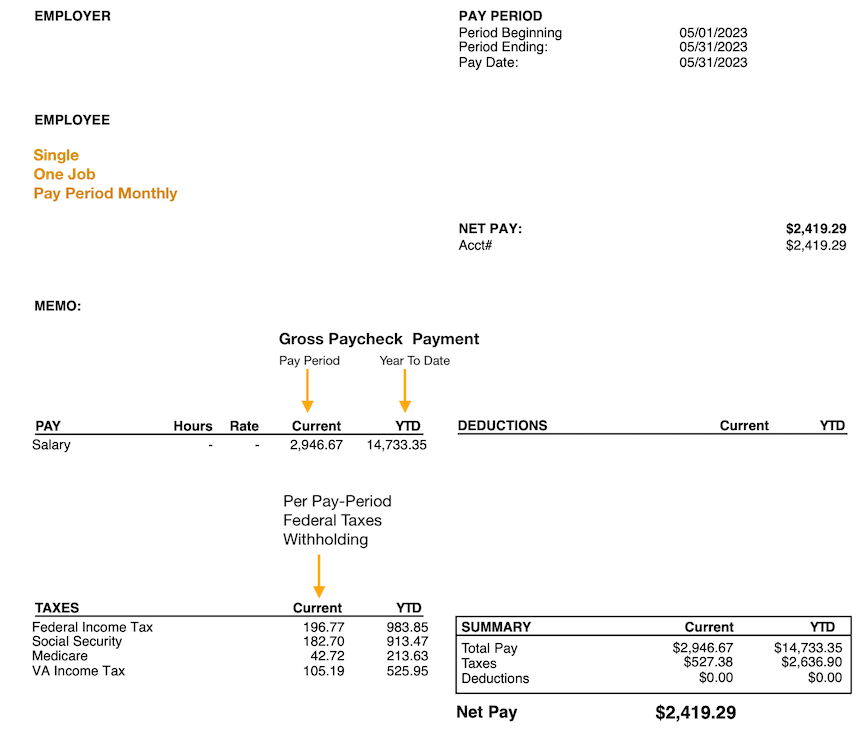

Paycheck & Tax Withholding Calculator for W-4: Tax Planning

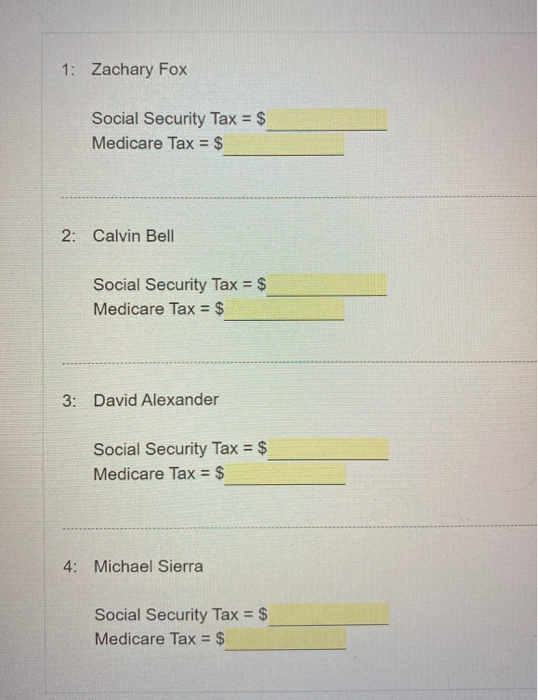

Solved Calcuinte Social Security and Medicare tax for the

How to Set Preferences in QuickBooks 2019 to Handle Taxes - dummies

Quick and Dirty Payroll for One-person S Corps - Evergreen Small

Understanding FICA and How It Affects Your Primary Insurance

Learn About FICA Tax and How To Calculate It

Inline XBRL Viewer

Real-Time Poverty, Material Well-Being, and the Child Tax Credit

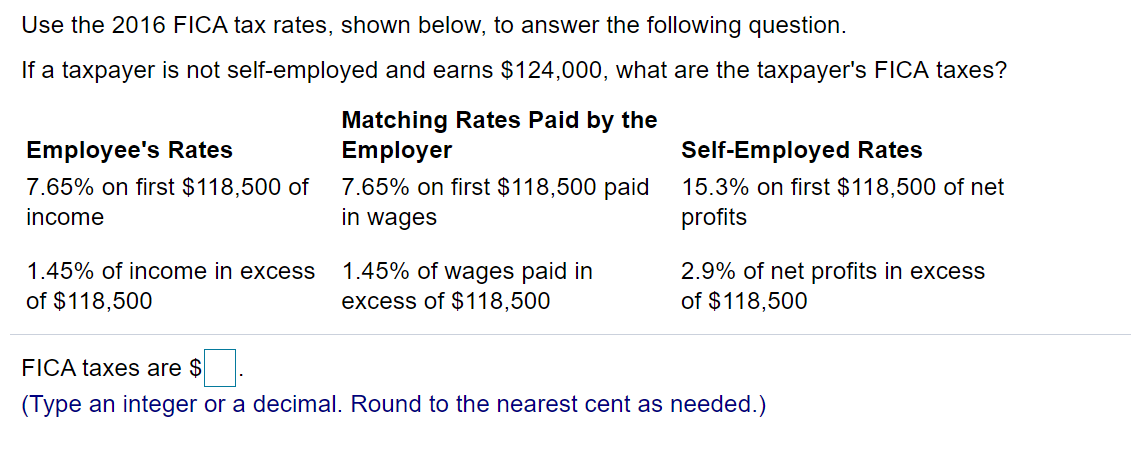

Solved Use the 2016 FICA tax rates, shown below, to answer

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog29 março 2025

-

FICA Tax: Understanding Social Security and Medicare Taxes29 março 2025

-

Employee Social Security Tax Deferral Repayment29 março 2025

Employee Social Security Tax Deferral Repayment29 março 2025 -

What is the FICA Tax Refund?29 março 2025

What is the FICA Tax Refund?29 março 2025 -

What Is FICA Tax?29 março 2025

What Is FICA Tax?29 março 2025 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax29 março 2025

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax29 março 2025 -

How Do I Get a FICA Tax Refund for F1 Students?29 março 2025

How Do I Get a FICA Tax Refund for F1 Students?29 março 2025 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine29 março 2025

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine29 março 2025 -

FICA Tax - An Explanation - RMS Accounting29 março 2025

FICA Tax - An Explanation - RMS Accounting29 março 2025 -

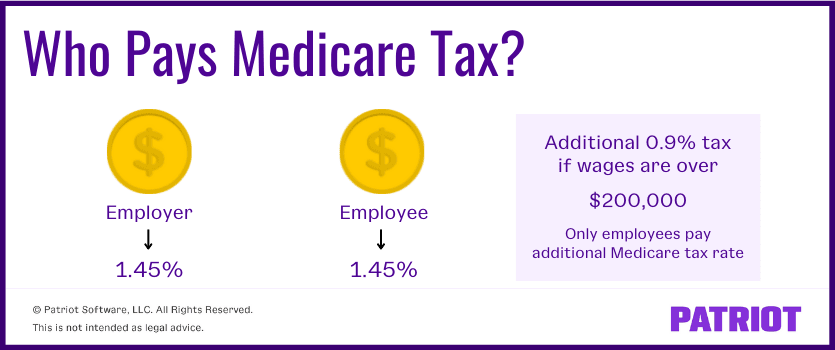

Unveiling the Mysteries of Medicare Tax: Employer & Employee Tax29 março 2025

Unveiling the Mysteries of Medicare Tax: Employer & Employee Tax29 março 2025

você pode gostar

-

Corporate Profile: Bamboo Sushi - Wild Salmon Center29 março 2025

Corporate Profile: Bamboo Sushi - Wild Salmon Center29 março 2025 -

Lance Rural transmite o Cavalo Crioulo na EXPOINTER ao vivo e29 março 2025

Lance Rural transmite o Cavalo Crioulo na EXPOINTER ao vivo e29 março 2025 -

Enquanto a França proíbe, a Espanha oficializa a linguagem neutra29 março 2025

Enquanto a França proíbe, a Espanha oficializa a linguagem neutra29 março 2025 -

Lucy | Elfen Lied Anime | Hardcover Journal29 março 2025

Lucy | Elfen Lied Anime | Hardcover Journal29 março 2025 -

I don't know what that is, but it sounds awesome! – Funny Anime Pics29 março 2025

I don't know what that is, but it sounds awesome! – Funny Anime Pics29 março 2025 -

Hataraku Maou-sama29 março 2025

Hataraku Maou-sama29 março 2025 -

15 jogos de graça pra resgatar em tempo limitado! 😱 #gamers29 março 2025

15 jogos de graça pra resgatar em tempo limitado! 😱 #gamers29 março 2025 -

The Last of Us Part 1 Is Getting Slammed on Steam Over PC Performance Issues - IGN29 março 2025

The Last of Us Part 1 Is Getting Slammed on Steam Over PC Performance Issues - IGN29 março 2025 -

“English is My Master; Tamil is My Beloved…”29 março 2025

“English is My Master; Tamil is My Beloved…”29 março 2025 -

Habla Usted Espanol Do You Speak Spanish Stock Illustration29 março 2025

Habla Usted Espanol Do You Speak Spanish Stock Illustration29 março 2025