Historical Social Security and FICA Tax Rates for a Family of Four

Por um escritor misterioso

Last updated 14 abril 2025

Average and marginal employee Social Security and Medicare (FICA) tax rates for two-parent families of four at the same relative positions in the income distribution from 1955 to 2015.

Social Security Act

What are FICA Taxes? 2022-2023 Rates and Instructions

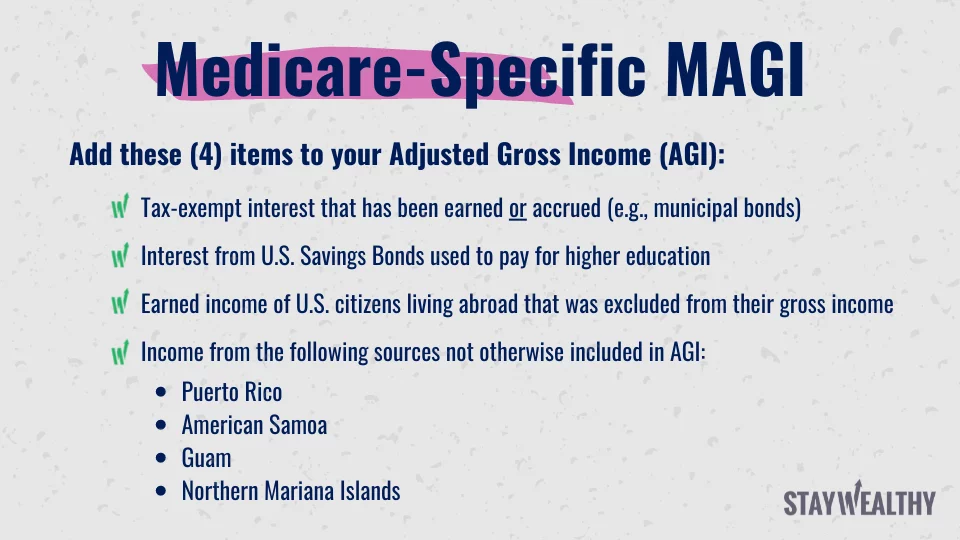

What Are the IRMAA 2024 Brackets (and How to Avoid It!)

Fast Facts & Figures About Social Security, 2020

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated?

Is Social Security Disability Income Taxable? - TurboTax Tax Tips & Videos

Increasing Payroll Taxes Would Strengthen Social Security

Social Security (United States) - Wikipedia

Marginal Federal Tax Rates on Labor Income: 1962 to 2028

Recomendado para você

-

What Is FICA Tax: How It Works And Why You Pay14 abril 2025

What Is FICA Tax: How It Works And Why You Pay14 abril 2025 -

FICA Tax Exemption for Nonresident Aliens Explained14 abril 2025

FICA Tax Exemption for Nonresident Aliens Explained14 abril 2025 -

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg) Why Is There a Cap on the FICA Tax?14 abril 2025

Why Is There a Cap on the FICA Tax?14 abril 2025 -

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents14 abril 2025

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents14 abril 2025 -

What is the FICA Tax Refund?14 abril 2025

What is the FICA Tax Refund?14 abril 2025 -

The FICA Tax: How Social Security Is Funded – Social Security Intelligence14 abril 2025

The FICA Tax: How Social Security Is Funded – Social Security Intelligence14 abril 2025 -

What Is FICA Tax?14 abril 2025

What Is FICA Tax?14 abril 2025 -

Vola14 abril 2025

Vola14 abril 2025 -

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com14 abril 2025

FICA refund for F1 visa / OPT / CPT students – 1040NRA.com14 abril 2025 -

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books14 abril 2025

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books14 abril 2025

você pode gostar

-

How Andrea Botez deals with her stalkers @Ford Motor Company14 abril 2025

-

HOGWARTS LEGACY EDIÇÃO DIGITAL DELUXE PS5 PSN MÍDIA DIGITAL - LA Games - Produtos Digitais e pelo melhor preço é aqui!14 abril 2025

HOGWARTS LEGACY EDIÇÃO DIGITAL DELUXE PS5 PSN MÍDIA DIGITAL - LA Games - Produtos Digitais e pelo melhor preço é aqui!14 abril 2025 -

Bleach Anime Poster Ichigo Kurosaki Soul Reaper Swords Manga Comic Cool Aesthetic Modern Picture Japanese Bedroom Home Living Room Weeb Fan Birthday14 abril 2025

Bleach Anime Poster Ichigo Kurosaki Soul Reaper Swords Manga Comic Cool Aesthetic Modern Picture Japanese Bedroom Home Living Room Weeb Fan Birthday14 abril 2025 -

Vetores de Vá E Tábuas De Shogi Com Pedaços Jogos Japoneses e mais imagens de A caminho - A caminho, Jogo de tabuleiro, Xadrez - Jogo de tabuleiro - iStock14 abril 2025

Vetores de Vá E Tábuas De Shogi Com Pedaços Jogos Japoneses e mais imagens de A caminho - A caminho, Jogo de tabuleiro, Xadrez - Jogo de tabuleiro - iStock14 abril 2025 -

Sasaki and Miyano Episode 1 - Beginning of a Wholesome Romance14 abril 2025

Sasaki and Miyano Episode 1 - Beginning of a Wholesome Romance14 abril 2025 -

quickdraw — quickdraw 1.0.0 Documentation14 abril 2025

quickdraw — quickdraw 1.0.0 Documentation14 abril 2025 -

GitHub - voxlol/typerush14 abril 2025

-

MK Art Tribute: Kano from MKDA in his alternate costume14 abril 2025

MK Art Tribute: Kano from MKDA in his alternate costume14 abril 2025 -

Code Vein – Split/Screen14 abril 2025

Code Vein – Split/Screen14 abril 2025 -

Meme PNG Images, Meme Clipart Free Download14 abril 2025

Meme PNG Images, Meme Clipart Free Download14 abril 2025