How Do the Used and Commercial Clean Vehicle Tax Credits Work?

Por um escritor misterioso

Last updated 29 março 2025

Beginning in 2023, there are two new EV tax credits: the Used Clean Vehicle Credit and the Commercial Clean Vehicle Credit. Here’s what you need to know.

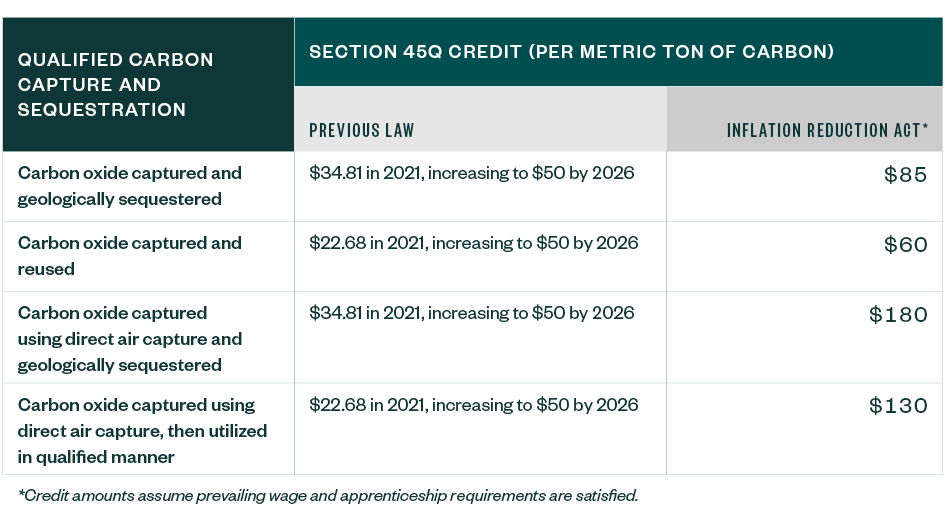

Clean Energy Credit Overview in Inflation Reduction Act

CA Electric vehicle tax incentives changing in 2024

Introducing The Commercial Clean Vehicle Tax Credit

What to know about the $7,500 IRS EV tax credit for electric cars in 2023 : NPR

Clean Vehicle Tax Credit

Government incentives for plug-in electric vehicles - Wikipedia

Every electric vehicle that qualifies for US federal tax credits

The Commercial Clean Vehicle Tax Credit

Going Green: States with the Best Electric Vehicle Tax Incentives

Leasing an EV Is a Workaround That Could Get You That Tax Credit

Recomendado para você

-

EVS Work - Voltz A gente muda. O mundo muda.29 março 2025

EVS Work - Voltz A gente muda. O mundo muda.29 março 2025 -

Electric Vehicles and Equity: How EVs Work, Their Pros and Cons, and the Role They Can Play in Making Our Communities Stronger - Clean Energy Group29 março 2025

Electric Vehicles and Equity: How EVs Work, Their Pros and Cons, and the Role They Can Play in Making Our Communities Stronger - Clean Energy Group29 março 2025 -

How Do EVs Work?29 março 2025

How Do EVs Work?29 março 2025 -

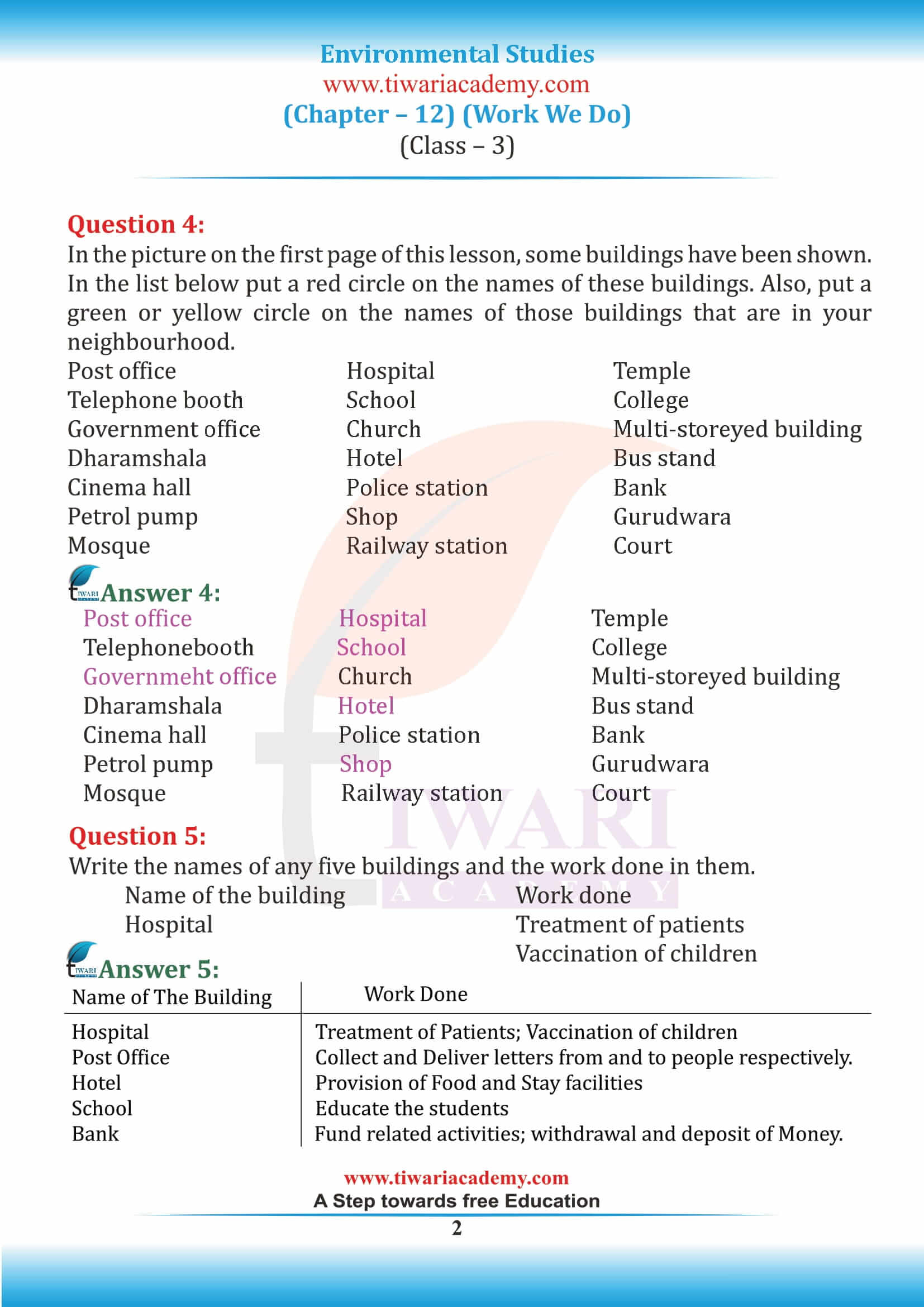

NCERT Solutions for Class 3 EVS Work We Do - CBSE Labs29 março 2025

NCERT Solutions for Class 3 EVS Work We Do - CBSE Labs29 março 2025 -

EVs explained: How do electric cars actually work and are they really better than traditional cars?29 março 2025

EVs explained: How do electric cars actually work and are they really better than traditional cars?29 março 2025 -

NCERT Solutions for Class 3 EVS Chapter 12 in Hindi and English Medium29 março 2025

NCERT Solutions for Class 3 EVS Chapter 12 in Hindi and English Medium29 março 2025 -

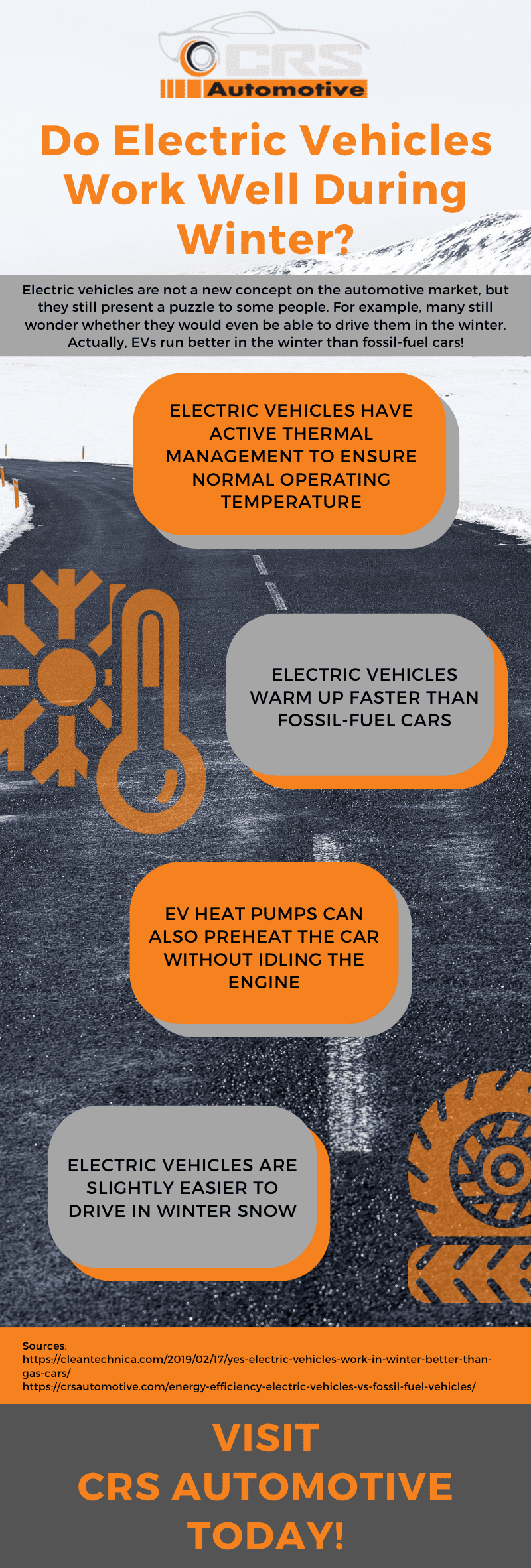

Do Electric Vehicles Work Well During Winter?29 março 2025

Do Electric Vehicles Work Well During Winter?29 março 2025 -

Your career in Environmental Services at CommonSpirit Health29 março 2025

Your career in Environmental Services at CommonSpirit Health29 março 2025 -

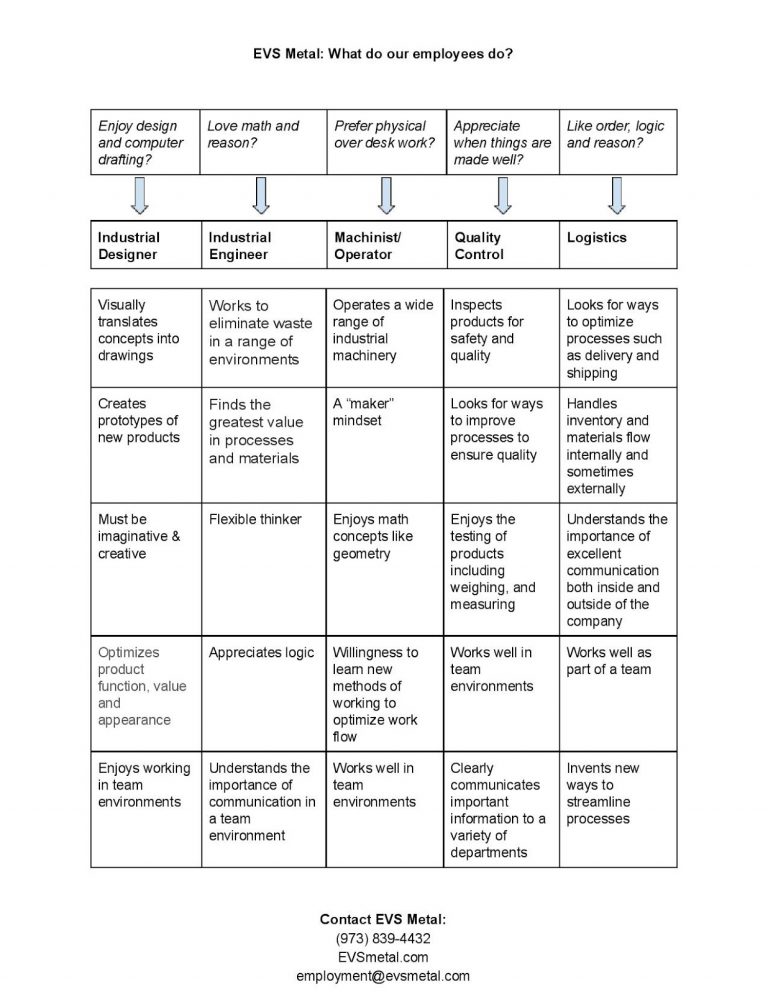

Careers in Metal Fabrication & Manufacturing29 março 2025

Careers in Metal Fabrication & Manufacturing29 março 2025 -

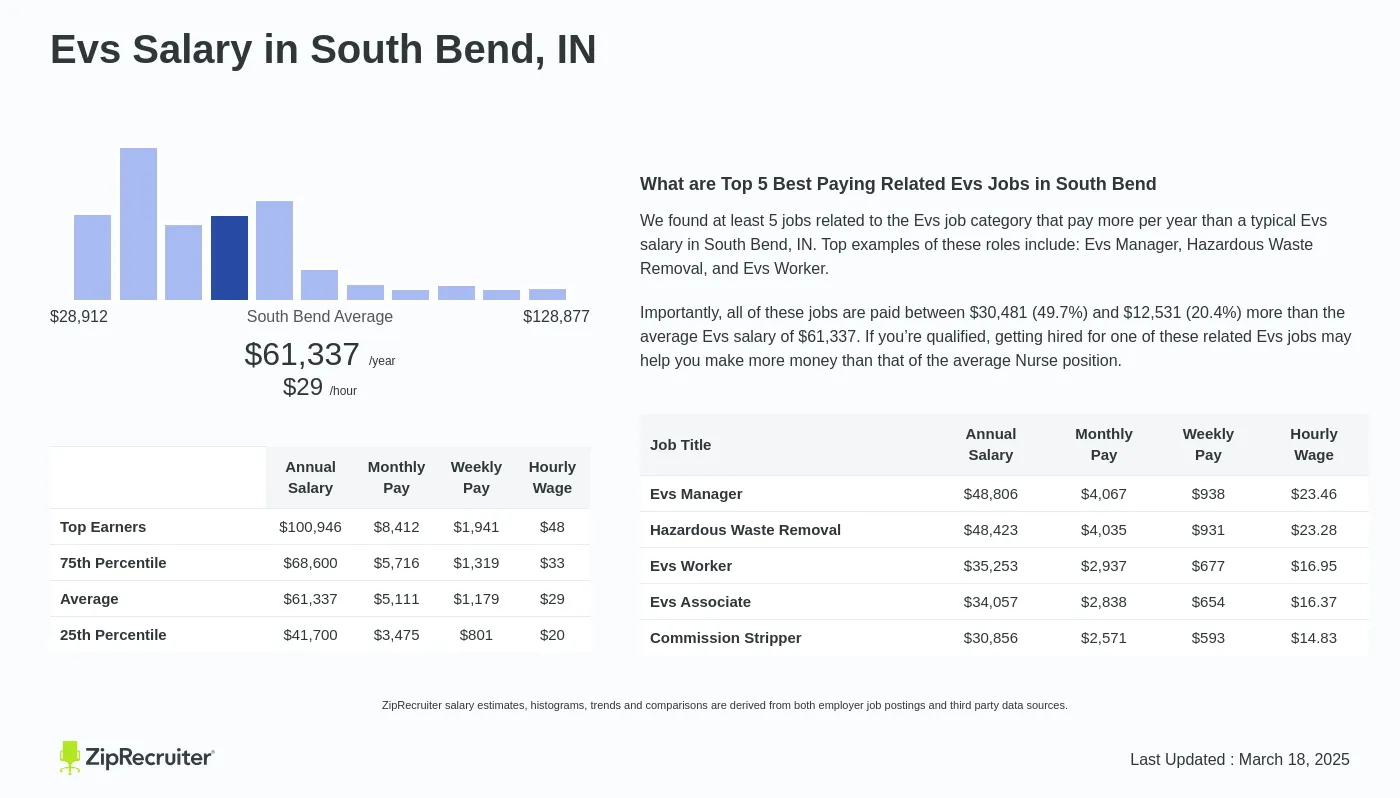

Evs Salary in South Bend, IN: Hourly Rate (2023, 2023)29 março 2025

Evs Salary in South Bend, IN: Hourly Rate (2023, 2023)29 março 2025

você pode gostar

-

Agario Bots - Download29 março 2025

Agario Bots - Download29 março 2025 -

Bioshock Infinite - Ps3 - 2K GAMES - Jogos de Aventura - Magazine29 março 2025

Bioshock Infinite - Ps3 - 2K GAMES - Jogos de Aventura - Magazine29 março 2025 -

Women's World Cup 2023: The five players you need to follow (and why): Sam Kerr, Alexia Putellas, Caroline Graham Hansen, Alex Morgan and Ada Hegerberg29 março 2025

-

What do you call the casino employee who operates the roulette29 março 2025

-

Como baixar e colocar jogos no PPSSPP emulador de psp para Android29 março 2025

Como baixar e colocar jogos no PPSSPP emulador de psp para Android29 março 2025 -

Car Parking - Play on29 março 2025

Car Parking - Play on29 março 2025 -

Sekai Saikou no Ansatsusha, Isekai Kizoku ni Tensei suru29 março 2025

-

Chainsaw Man, Vol. 5: Volume 529 março 2025

Chainsaw Man, Vol. 5: Volume 529 março 2025 -

Samsung's virtual girl “Sam” - Blender screenshots - BlenderNation29 março 2025

Samsung's virtual girl “Sam” - Blender screenshots - BlenderNation29 março 2025 -

Undertale Ink Sans Sticker - Sticker Mania29 março 2025

Undertale Ink Sans Sticker - Sticker Mania29 março 2025