What Is Social Security Tax? Definition, Exemptions, and Example

Por um escritor misterioso

Last updated 12 janeiro 2025

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

The Social Security tax, levied on both employers and employees, funds Social Security and is collected in the form of a payroll tax or a self-employment tax.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax? Definition, Exemptions, and Example

:max_bytes(150000):strip_icc()/USSSCard-ed3cb5248ef842ee89c9ae1bb60e4fbd.jpg)

Who Is Exempt From Paying Into Social Security?

7 Things to Know About Social Security and Taxes

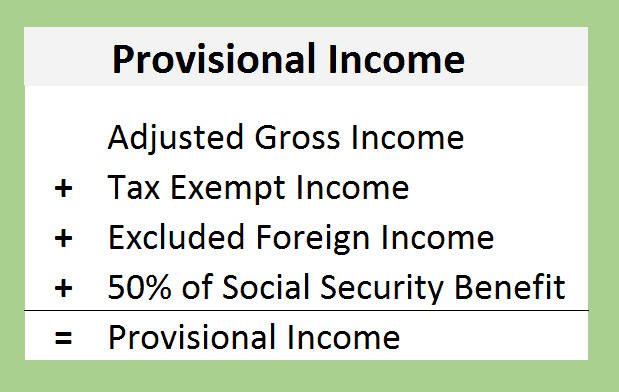

Research: Income Taxes on Social Security Benefits

What is Backup Withholding Tax

Tax on Social Security Benefits – Social Security Intelligence

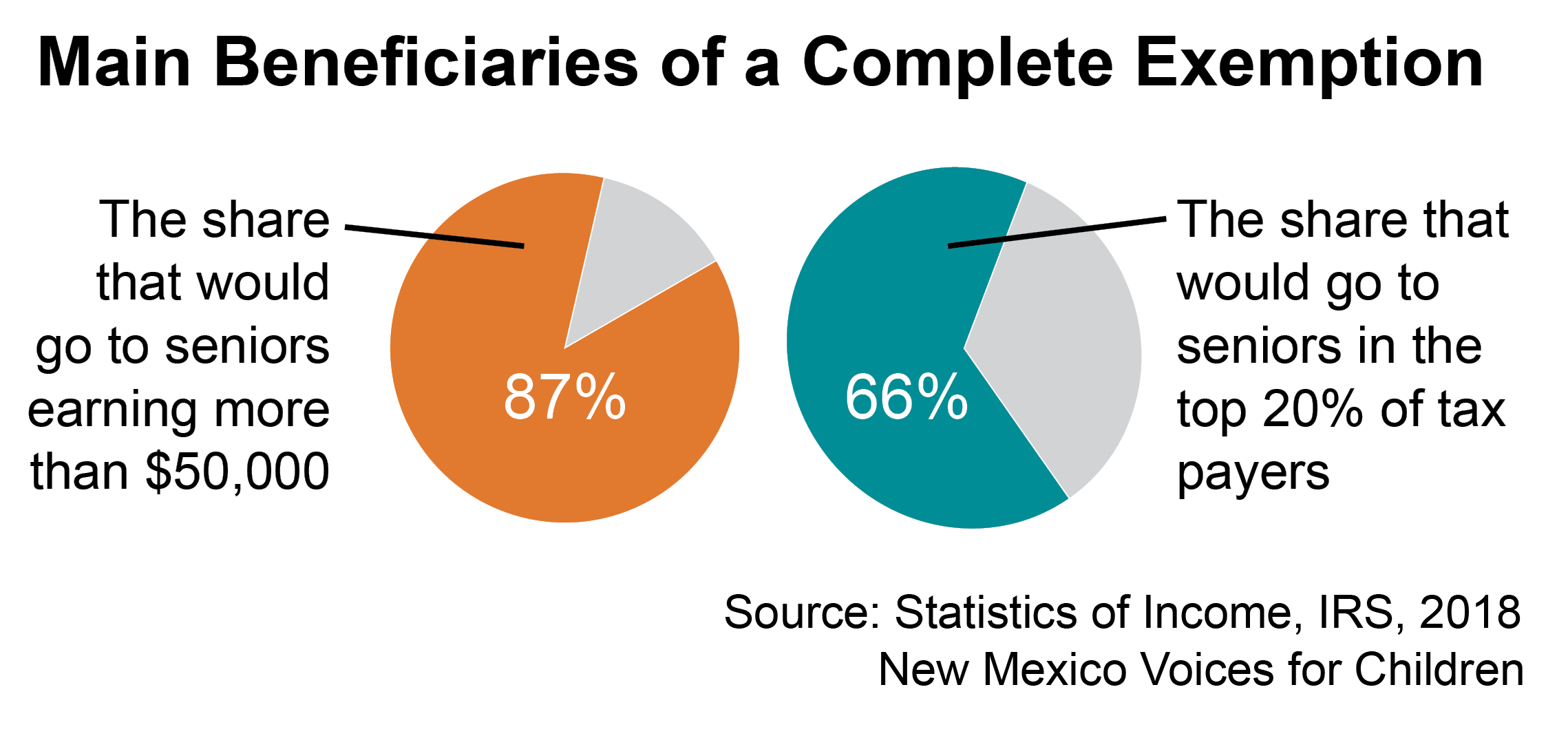

Exempting Social Security Income from Taxation: Not Targeted, Not Necessary, Not Cheap – New Mexico Voices for Children

Different Types of Payroll Deductions

Recomendado para você

-

Important 2020 Federal Tax Deadlines for Small Businesses - Workest12 janeiro 2025

Important 2020 Federal Tax Deadlines for Small Businesses - Workest12 janeiro 2025 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202312 janeiro 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202312 janeiro 2025 -

Historical Social Security and FICA Tax Rates for a Family of Four12 janeiro 2025

Historical Social Security and FICA Tax Rates for a Family of Four12 janeiro 2025 -

Do You Have To Pay Tax On Your Social Security Benefits?12 janeiro 2025

Do You Have To Pay Tax On Your Social Security Benefits?12 janeiro 2025 -

FICA explained: Social Security and Medicare tax rates to know in 202312 janeiro 2025

FICA explained: Social Security and Medicare tax rates to know in 202312 janeiro 2025 -

What it means: COVID-19 Deferral of Employee FICA Tax12 janeiro 2025

What it means: COVID-19 Deferral of Employee FICA Tax12 janeiro 2025 -

2017 FICA Tax: What You Need to Know12 janeiro 2025

2017 FICA Tax: What You Need to Know12 janeiro 2025 -

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons12 janeiro 2025

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons12 janeiro 2025 -

FICA TAX PROVISIONS (1967-1980)12 janeiro 2025

FICA TAX PROVISIONS (1967-1980)12 janeiro 2025 -

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset12 janeiro 2025

FICA Tax Guide (2023): Payroll Tax Rates & Definition - SmartAsset12 janeiro 2025

você pode gostar

-

Gift Card Digital Roblox $300 MXN - Mobile - Compre na Nuuvem12 janeiro 2025

Gift Card Digital Roblox $300 MXN - Mobile - Compre na Nuuvem12 janeiro 2025 -

From Strangers to Friends to Best Friends to Strangers Again, by TzeLin Sam12 janeiro 2025

From Strangers to Friends to Best Friends to Strangers Again, by TzeLin Sam12 janeiro 2025 -

Tensions rise in SAfrican white supremacist case - The San Diego Union-Tribune12 janeiro 2025

-

Los Santos Rock Radio12 janeiro 2025

Los Santos Rock Radio12 janeiro 2025 -

Bubble Hit - Jogue Bubble Hit Jogo Online12 janeiro 2025

Bubble Hit - Jogue Bubble Hit Jogo Online12 janeiro 2025 -

cyber y2k male outfits roblox|Búsqueda de TikTok12 janeiro 2025

cyber y2k male outfits roblox|Búsqueda de TikTok12 janeiro 2025 -

Retratos Fantasmas estreia na Netflix12 janeiro 2025

Retratos Fantasmas estreia na Netflix12 janeiro 2025 -

SUPER MX - THE CHAMPION - Jogue Grátis Online!12 janeiro 2025

-

Desenho de cabeça de cavalo para colorir12 janeiro 2025

Desenho de cabeça de cavalo para colorir12 janeiro 2025 -

Dawn Stone Location in Pokemon Brilliant Diamond & Shining Pearl - Try Hard Guides12 janeiro 2025

Dawn Stone Location in Pokemon Brilliant Diamond & Shining Pearl - Try Hard Guides12 janeiro 2025