Understanding FICA Taxes and Wage Base Limit

Por um escritor misterioso

Last updated 30 março 2025

Employers deduct a certain amount from employee paychecks to pay federal income tax, Social Security tax, Medicare (Hospital Insurance) tax, and state income

What is FICA Tax? - The TurboTax Blog

FICA explained: Social Security and Medicare tax rates to know in 2023

Understanding FICA Taxes

Employers: In 2023, the Social Security Wage Base is Going Up

Understanding Your Tax Forms: The W-2

2023 Social Security Wage Cap Jumps to $160,200 for Payroll Taxes

Income Limit For Maximum Social Security Tax 2023 - Financial Samurai

Employee Retention Credit - Anfinson Thompson & Co.

What is a payroll tax? Payroll tax definition, types, and

Solved] estion list The total wage expense for Kiln Co. was

2021 Wage Base Rises for Social Security Payroll Taxes

Gross vs. Net Pay: The Difference Between Gross and Net Income

Publication 505 (2023), Tax Withholding and Estimated Tax

What are FICA Taxes? 2022-2023 Rates and Instructions

Maximum Taxable Income Amount For Social Security Tax (FICA)

Recomendado para você

-

What is FICA Tax? - The TurboTax Blog30 março 2025

-

What is FICA30 março 2025

What is FICA30 março 2025 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays30 março 2025

Federal Insurance Contributions Act (FICA): What It Is, Who Pays30 março 2025 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202330 março 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202330 março 2025 -

2023 FICA Tax Limits and Rates (How it Affects You)30 março 2025

2023 FICA Tax Limits and Rates (How it Affects You)30 março 2025 -

FICA Tax Exemption for Nonresident Aliens Explained30 março 2025

FICA Tax Exemption for Nonresident Aliens Explained30 março 2025 -

FICA Tax in 2022-2023: What Small Businesses Need to Know30 março 2025

FICA Tax in 2022-2023: What Small Businesses Need to Know30 março 2025 -

Withholding FICA Tax on Nonresident employees and Foreign Workers30 março 2025

Withholding FICA Tax on Nonresident employees and Foreign Workers30 março 2025 -

FICA explained: Social Security and Medicare tax rates to know in 202330 março 2025

FICA explained: Social Security and Medicare tax rates to know in 202330 março 2025 -

How Do I Get a FICA Tax Refund for F1 Students?30 março 2025

How Do I Get a FICA Tax Refund for F1 Students?30 março 2025

você pode gostar

-

Banbaleena Garten of Banban Plush Toys Soft Stuffed Plushie Toy Doll Garden30 março 2025

Banbaleena Garten of Banban Plush Toys Soft Stuffed Plushie Toy Doll Garden30 março 2025 -

Giving/Donate - Our Lady of Africa30 março 2025

Giving/Donate - Our Lady of Africa30 março 2025 -

Jogos de bolas - Jogue jogos de bolas gratis no30 março 2025

Jogos de bolas - Jogue jogos de bolas gratis no30 março 2025 -

The Last of Us para PC? Desenvolvedor especula data de lançamento30 março 2025

The Last of Us para PC? Desenvolvedor especula data de lançamento30 março 2025 -

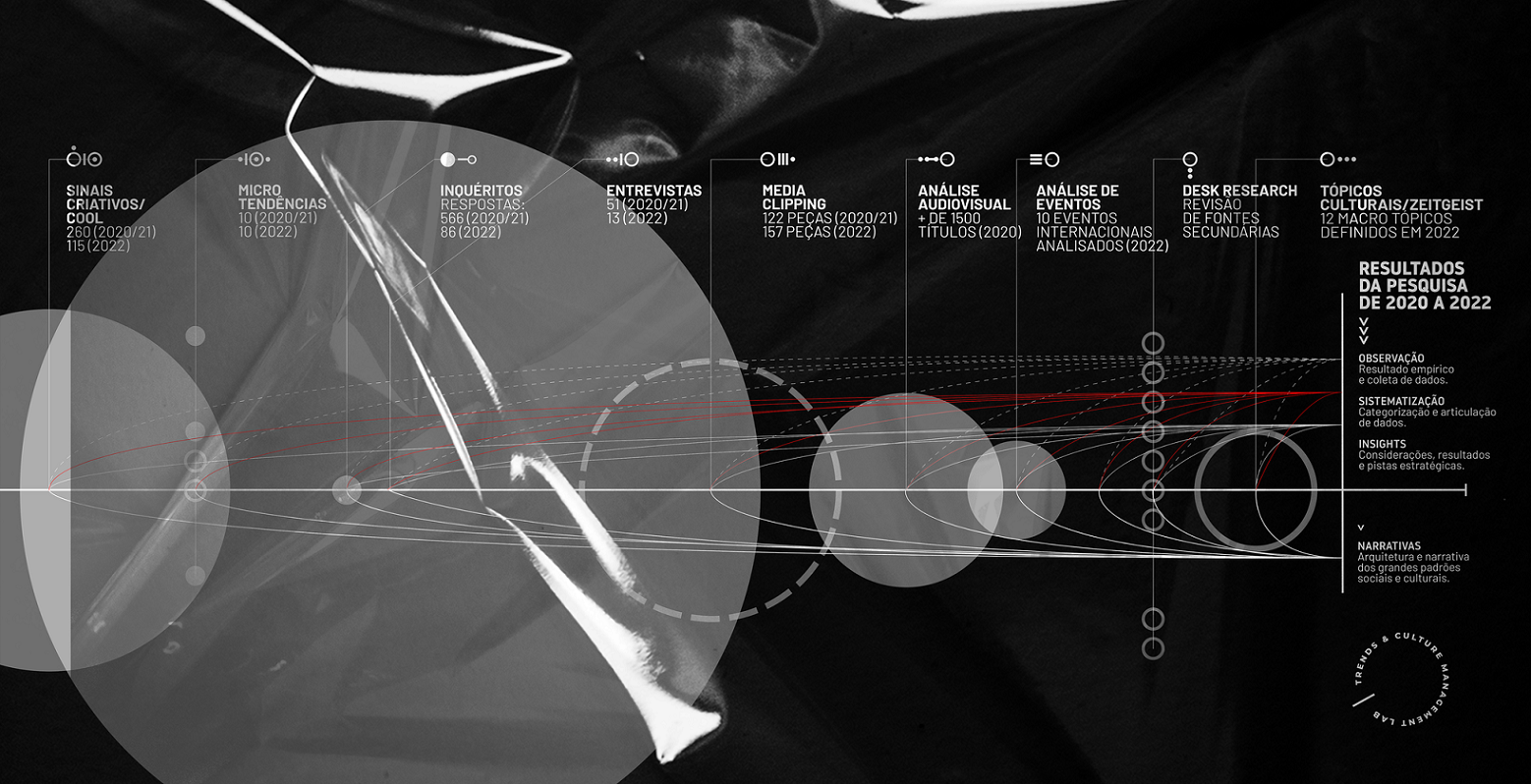

Tendências Socioculturais 2022 — Colossos e Decadências – Programa de Cultura e Comunicação30 março 2025

Tendências Socioculturais 2022 — Colossos e Decadências – Programa de Cultura e Comunicação30 março 2025 -

Sonic Frontiers - Super Sonic 2: Cyber Super Sonic by rossyfilms30 março 2025

Sonic Frontiers - Super Sonic 2: Cyber Super Sonic by rossyfilms30 março 2025 -

Animellow Explore - LEAKS: In latest Boruto's chapter Sarada has finally Awakened her Mangekyou Sharingan! Also Boruto Manga going on hiatus for 3 months30 março 2025

-

Kimi to Boku no Saigo no Senjou Folder Icon by Kiddblaster on DeviantArt30 março 2025

Kimi to Boku no Saigo no Senjou Folder Icon by Kiddblaster on DeviantArt30 março 2025 -

Coming soon! Play with Me — Lorraine Nam / Illustrator30 março 2025

Coming soon! Play with Me — Lorraine Nam / Illustrator30 março 2025 -

Fortress Of The Muslim: Hisnul Muslim. Invocations and30 março 2025

Fortress Of The Muslim: Hisnul Muslim. Invocations and30 março 2025