Tax Number Duplicity Restriction (CNPJ, CPF, State Inscription)

Por um escritor misterioso

Last updated 29 março 2025

Since the companies in Brazil must not have 2 partners to the same CNPJ and/or State Inscription (IE), or CPF, you can prevent that 2 customer master records or 2 vendors created to the same Tax ID using

What is a CPF or a CNPJ? How to get one and what you should know

TAXBRA – SAP Blog, SAP BRAZIL, SAP S/4HANA and more…

Tax Number Duplicity Restriction (CNPJ, CPF, State Inscription

Tax Number Duplicity Restriction (CNPJ, CPF, State Inscription

How to add Tax ID (CPF for Brazil) - Dropshipman

TAXBRA – SAP Blog, SAP BRAZIL, SAP S/4HANA and more…

cpf SAP Blogs

Recomendado para você

-

Certificado Digital29 março 2025

Certificado Digital29 março 2025 -

Kit Let Me Be Progressive Supreme Mask Keratin Intense Shine 2x500ml/2x16.9fl.oz29 março 2025

Kit Let Me Be Progressive Supreme Mask Keratin Intense Shine 2x500ml/2x16.9fl.oz29 março 2025 -

Would You Drink Wine from A Can? Here's Why You Should Consider It29 março 2025

Would You Drink Wine from A Can? Here's Why You Should Consider It29 março 2025 -

Drone 4K 1080P HD – Drou eletrônicos 2023 - CNPJ: 49.260.527/0001-4429 março 2025

Drone 4K 1080P HD – Drou eletrônicos 2023 - CNPJ: 49.260.527/0001-4429 março 2025 -

Absurd or Astute: Brazil's Political Ads - The New York Times29 março 2025

Absurd or Astute: Brazil's Political Ads - The New York Times29 março 2025 -

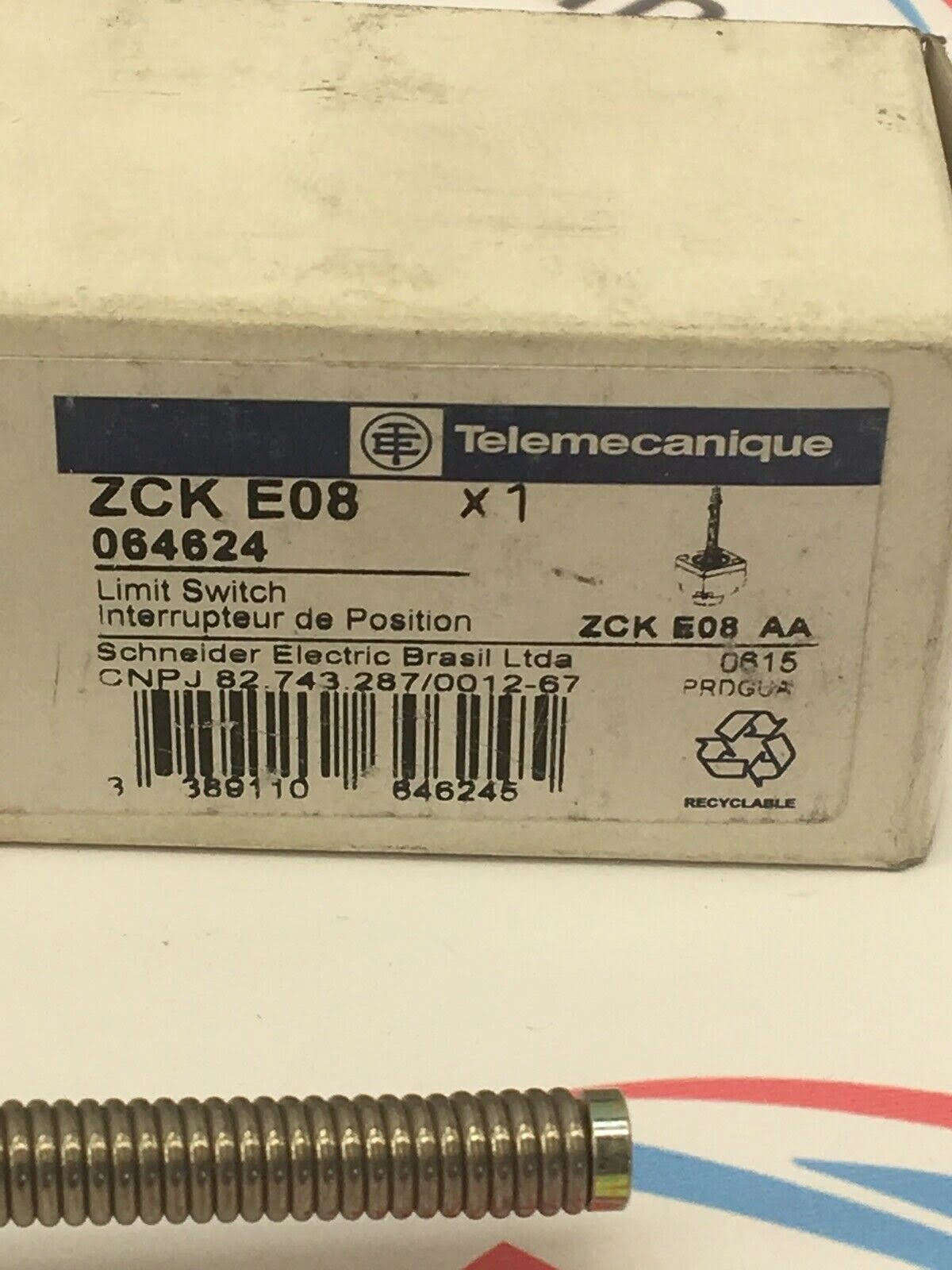

TELEMECANIQUE LIMIT SWITCH ZCK E0829 março 2025

TELEMECANIQUE LIMIT SWITCH ZCK E0829 março 2025 -

What type of Battery? Lead Acid or AGM, Page 429 março 2025

-

Brazilian-American Chamber of Commerce29 março 2025

Brazilian-American Chamber of Commerce29 março 2025 -

imposto para fonoaudiólogo29 março 2025

imposto para fonoaudiólogo29 março 2025 -

TEMPORIZADOR CONTROLADOR DE VÁLVULA INTELIGENTE LCD CONTROLE DE ÁGUA - Insumos - Compra Coletiva MG29 março 2025

TEMPORIZADOR CONTROLADOR DE VÁLVULA INTELIGENTE LCD CONTROLE DE ÁGUA - Insumos - Compra Coletiva MG29 março 2025

você pode gostar

-

Fortnite: How to Complete The Nindo 2022 Naruto Quests29 março 2025

Fortnite: How to Complete The Nindo 2022 Naruto Quests29 março 2025 -

Blox Fruit - Account Lv 2200 with ( Random Fruit - Superhuman - Random Legendary Sword - unverified )29 março 2025

Blox Fruit - Account Lv 2200 with ( Random Fruit - Superhuman - Random Legendary Sword - unverified )29 março 2025 -

Zombies Ate My Neighbors • 1xLP – Black Screen Records29 março 2025

Zombies Ate My Neighbors • 1xLP – Black Screen Records29 março 2025 -

Vestido Xadrez Bege com Gola em Bordado Inglês em 202329 março 2025

Vestido Xadrez Bege com Gola em Bordado Inglês em 202329 março 2025 -

Wizard Level Up29 março 2025

Wizard Level Up29 março 2025 -

Mr.Kitty - Vocaloid Database29 março 2025

Mr.Kitty - Vocaloid Database29 março 2025 -

alphabet lore a Minecraft Skins29 março 2025

alphabet lore a Minecraft Skins29 março 2025 -

/cdn.vox-cdn.com/uploads/chorus_asset/file/24698261/10_bdde6776_6fd4_4a8a_ab3a_a6ff430228d3.jpg) This DIY kit lets you use an old Nintendo 64 controller wirelessly with the Switch - The Verge29 março 2025

This DIY kit lets you use an old Nintendo 64 controller wirelessly with the Switch - The Verge29 março 2025 -

10 Most Generic Pokémon Gym Leaders29 março 2025

10 Most Generic Pokémon Gym Leaders29 março 2025 -

![GIF] Me on the Computer by Deep-Strike on DeviantArt](https://images-wixmp-ed30a86b8c4ca887773594c2.wixmp.com/f/05f57344-fbaf-4018-9f57-8846395ba4b6/d7eobsn-c6494b68-cf26-4c00-beac-6eaf2d6ae688.gif?token=eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzI1NiJ9.eyJzdWIiOiJ1cm46YXBwOjdlMGQxODg5ODIyNjQzNzNhNWYwZDQxNWVhMGQyNmUwIiwiaXNzIjoidXJuOmFwcDo3ZTBkMTg4OTgyMjY0MzczYTVmMGQ0MTVlYTBkMjZlMCIsIm9iaiI6W1t7InBhdGgiOiJcL2ZcLzA1ZjU3MzQ0LWZiYWYtNDAxOC05ZjU3LTg4NDYzOTViYTRiNlwvZDdlb2Jzbi1jNjQ5NGI2OC1jZjI2LTRjMDAtYmVhYy02ZWFmMmQ2YWU2ODguZ2lmIn1dXSwiYXVkIjpbInVybjpzZXJ2aWNlOmZpbGUuZG93bmxvYWQiXX0.Hopl_YQmGH3zBdocEjpGGybLTWl0JaZgIFkb1k3tHHo) GIF] Me on the Computer by Deep-Strike on DeviantArt29 março 2025

GIF] Me on the Computer by Deep-Strike on DeviantArt29 março 2025