Online Games : Valuation & Classification of Service : GST Law of India

Por um escritor misterioso

Last updated 09 abril 2025

Lok Sabha Passes Amendments To GST Bills To Tax Online Gaming, Horse Racing and Casinos At 28%

Online games of chance vs games of skill: What SC staying Karnataka HC order means

OIDAR in India: 2023 and Beyond

Explained Will 28% GST on online gaming affect its growth? - The Hindu

Death By GST? Why Real-Money Gaming Startups Are Crying Havoc

Online gaming companies to collect 28% on full bet value, offshore platforms to be GST registered from October 1 - The Hindu

Get To Know about GST Registration for Freelancers

How To Value Supplies in Online Gaming and Casino: GST Implications

India's New Gaming Tax Plan Demands $12B From Online Operators

Goods and Services Tax on Metaverse Transactions in India

40 Online Gaming Firms Likely To Receive Fresh Tax Demand Of INR 10,000 Cr Following 28% GST Decision

Recomendado para você

-

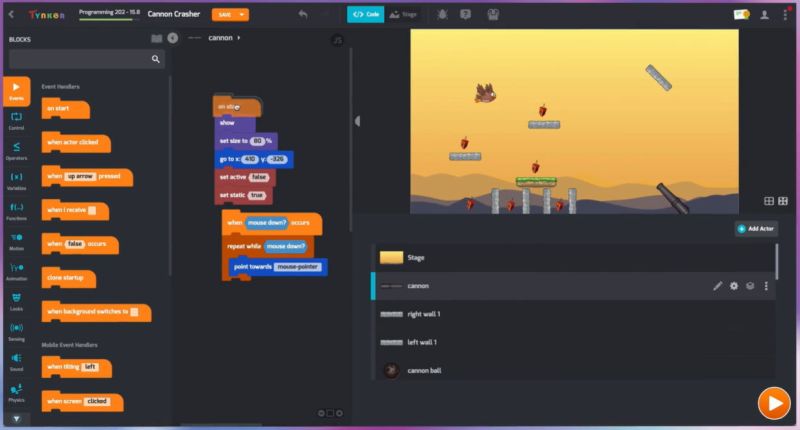

PLAY Unblocked Games for School Online Free Unblocked Games for School Play Right Now Free09 abril 2025

-

40+ Best Online Educational Games for Every Grade in 202309 abril 2025

40+ Best Online Educational Games for Every Grade in 202309 abril 2025 -

Top 12 New Online Multiplayer Games for Android YOU MUST PLAY09 abril 2025

Top 12 New Online Multiplayer Games for Android YOU MUST PLAY09 abril 2025 -

Video Games That Pioneered Online Multiplayer Before It Was Popular09 abril 2025

Video Games That Pioneered Online Multiplayer Before It Was Popular09 abril 2025 -

Top 25 Poki Games online: Subway Surfers, Candy Crush Saga, Angry Birds, Super Mario and Sonic09 abril 2025

Top 25 Poki Games online: Subway Surfers, Candy Crush Saga, Angry Birds, Super Mario and Sonic09 abril 2025 -

Top 25 Poki Games online: Subway Surfers, Candy Crush Saga, Angry09 abril 2025

Top 25 Poki Games online: Subway Surfers, Candy Crush Saga, Angry09 abril 2025 -

7 Online Multiplayer Games to Play With Friends For Free - Insider Guides09 abril 2025

7 Online Multiplayer Games to Play With Friends For Free - Insider Guides09 abril 2025 -

Squid Game Online 🕹️ Play on CrazyGames09 abril 2025

-

Scrabble, Free Online Multiplayer Word Game09 abril 2025

Scrabble, Free Online Multiplayer Word Game09 abril 2025 -

/cdn.vox-cdn.com/uploads/chorus_image/image/66632119/boardgamearena.0.png) Board Game Arena: The best way to play board games with friends online - Vox09 abril 2025

Board Game Arena: The best way to play board games with friends online - Vox09 abril 2025

você pode gostar

-

Baixar Dungeon Ward - RPG offline para PC - LDPlayer09 abril 2025

-

Apostila Digital Pingentes Fofinhos09 abril 2025

Apostila Digital Pingentes Fofinhos09 abril 2025 -

Doors Entities Figure Rush Ambush A-60 A-90 A-120 Seek Stare El Goblino Dupe Halt Jeff Bob Eyes Screech Jack Glitch Timothy Shadow Window iPad Case & Skin for Sale by TheBullishRhino09 abril 2025

Doors Entities Figure Rush Ambush A-60 A-90 A-120 Seek Stare El Goblino Dupe Halt Jeff Bob Eyes Screech Jack Glitch Timothy Shadow Window iPad Case & Skin for Sale by TheBullishRhino09 abril 2025 -

:strip_icc()/i.s3.glbimg.com/v1/AUTH_59edd422c0c84a879bd37670ae4f538a/internal_photos/bs/2017/i/J/aMNeMDQTOUgIz22SailA/gol-quadrado-2-.jpg) Por adrenalina, dono diz ter investido R$ 170 mil em Gol 'quadrado' de 650 cv09 abril 2025

Por adrenalina, dono diz ter investido R$ 170 mil em Gol 'quadrado' de 650 cv09 abril 2025 -

NBA latest scores 2023: Results from games today, how to live09 abril 2025

-

Emoticon Com Problema Da Queda De Cabelo Ilustração do Vetor09 abril 2025

Emoticon Com Problema Da Queda De Cabelo Ilustração do Vetor09 abril 2025 -

Dr. STONE Oído a distancias infinitas - Ver en Crunchyroll en castellano09 abril 2025

-

Blue Spring Ride Episode 6: Sisters Before Misters – Beneath the Tangles09 abril 2025

Blue Spring Ride Episode 6: Sisters Before Misters – Beneath the Tangles09 abril 2025 -

One Tree Hill: The Complete First Season (DVD)09 abril 2025

One Tree Hill: The Complete First Season (DVD)09 abril 2025 -

Frosinone confirm promotion to Serie A - Football Italia09 abril 2025

Frosinone confirm promotion to Serie A - Football Italia09 abril 2025