Itemize - Home

Por um escritor misterioso

Last updated 17 abril 2025

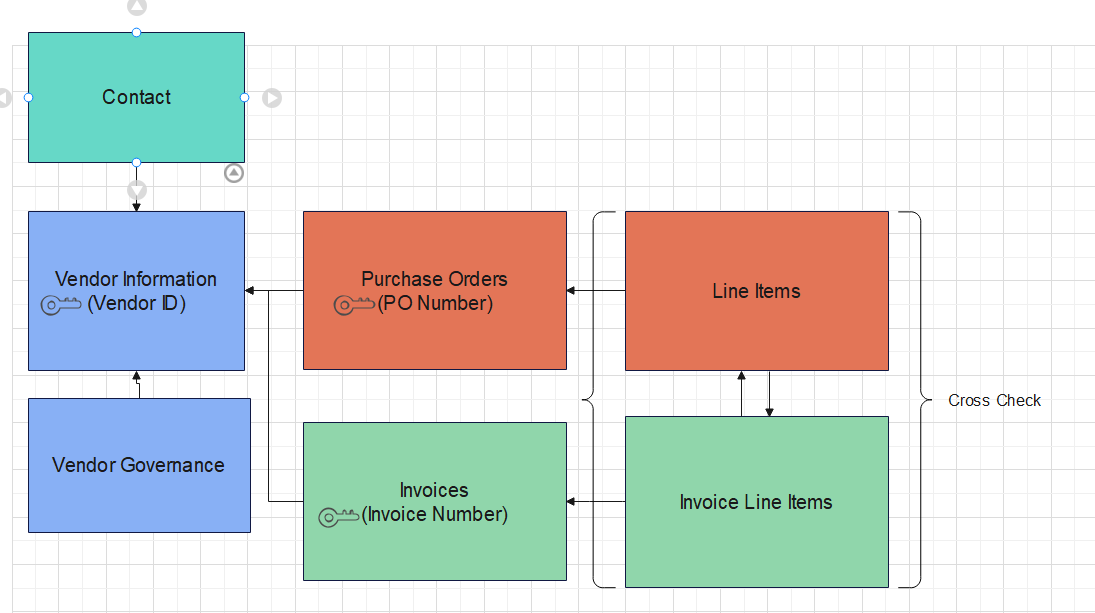

Itemize automates B2B financial document processing, enhances risk assessment, and helps approve transactions via streamlined information flows and improved business intelligence.

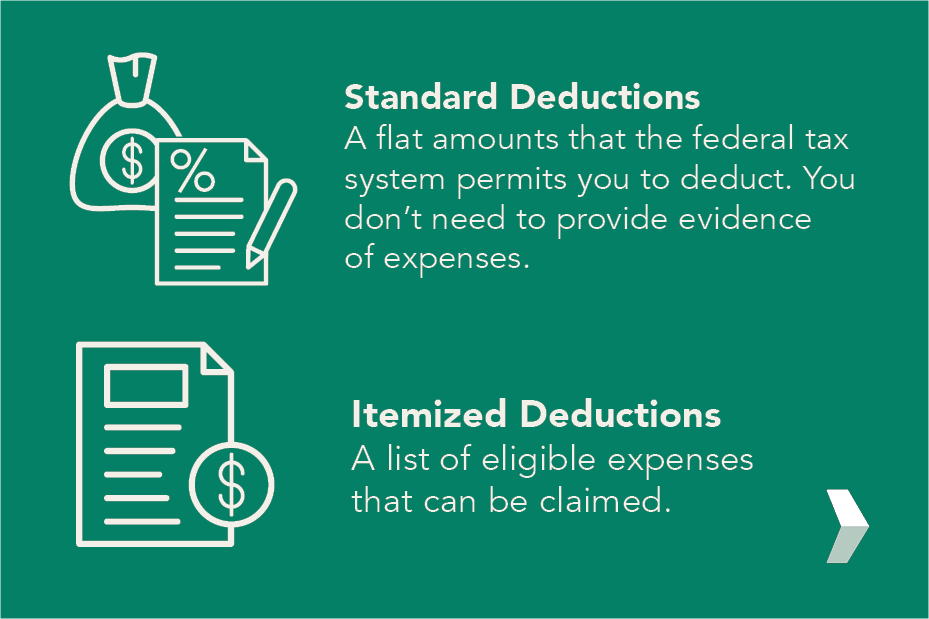

Do existing tax incentives increase homeownership?

Are you paying more taxes than you have to? There are more than nineteen million home-based businesses in the United States—56 percent of all

Write It Off! Deduct It!: The A-to-Z Guide to Tax Deductions for Home-Based Businesses

Homeowner Tax Breaks: 7 Deductions to Reduce What You Owe the IRS

Are closing costs tax deductible?, New Homes

Are Home Improvements Tax Deductible?

Housing Tax Deductions & Limitations

Solved) - A self-employed taxpayer who itemized deductions owns a home, of (1 Answer)

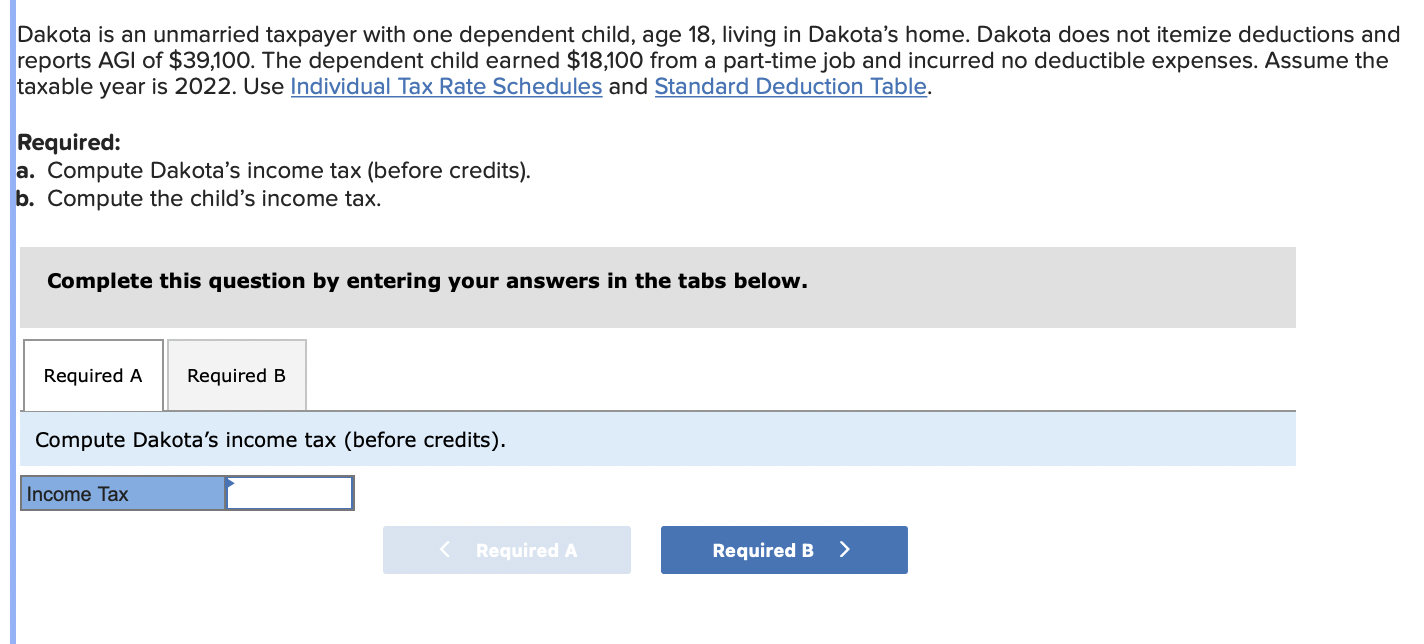

Solved Dakota is an unmarried taxpayer with one dependent

4 Tax Benefits Built Into Home Ownership - Venture CPAs - Accounting Firm Aurora

PacRes Mortgage

Get a Tax Credit for Buying a House

Can the Self-Employed Deduct their Home Mortgage Interest?

Home Ownership Tax Deductions - TurboTax Tax Tips & Videos

Recomendado para você

-

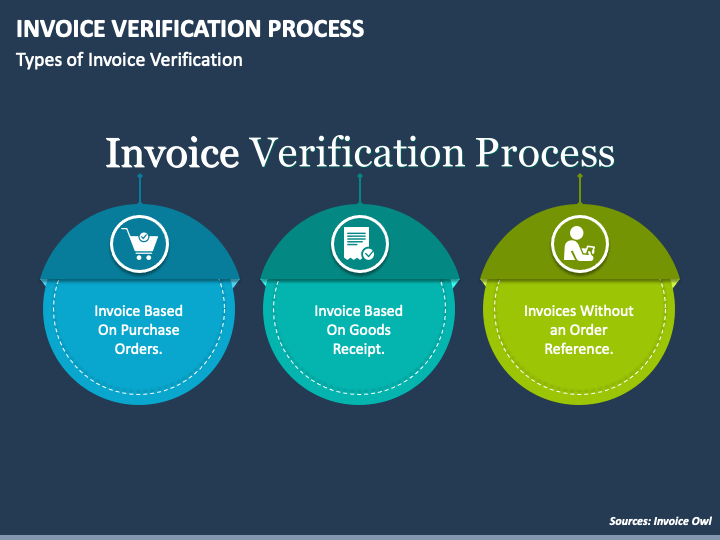

Invoice Verification Process PowerPoint Template - PPT Slides17 abril 2025

Invoice Verification Process PowerPoint Template - PPT Slides17 abril 2025 -

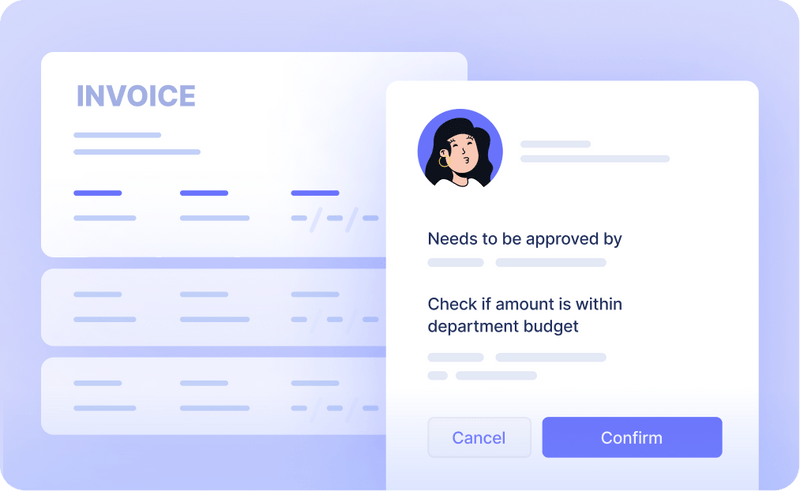

AP Automation & Audits Fight Fraud - Stampli17 abril 2025

AP Automation & Audits Fight Fraud - Stampli17 abril 2025 -

Invoice With Check Mark And Cross Sign On Mobile Phone Screen. Paper Invoice, Shopping Cash Bill Slip, Buying Tax Transaction Service. Vector Illustration Royalty Free SVG, Cliparts, Vectors, and Stock Illustration. Image17 abril 2025

Invoice With Check Mark And Cross Sign On Mobile Phone Screen. Paper Invoice, Shopping Cash Bill Slip, Buying Tax Transaction Service. Vector Illustration Royalty Free SVG, Cliparts, Vectors, and Stock Illustration. Image17 abril 2025 -

8 Key Strategies to Streamlining Invoice Submission Process17 abril 2025

8 Key Strategies to Streamlining Invoice Submission Process17 abril 2025 -

Checking Invoices with Accuracy17 abril 2025

-

Free Purchase Order (PO) Template17 abril 2025

Free Purchase Order (PO) Template17 abril 2025 -

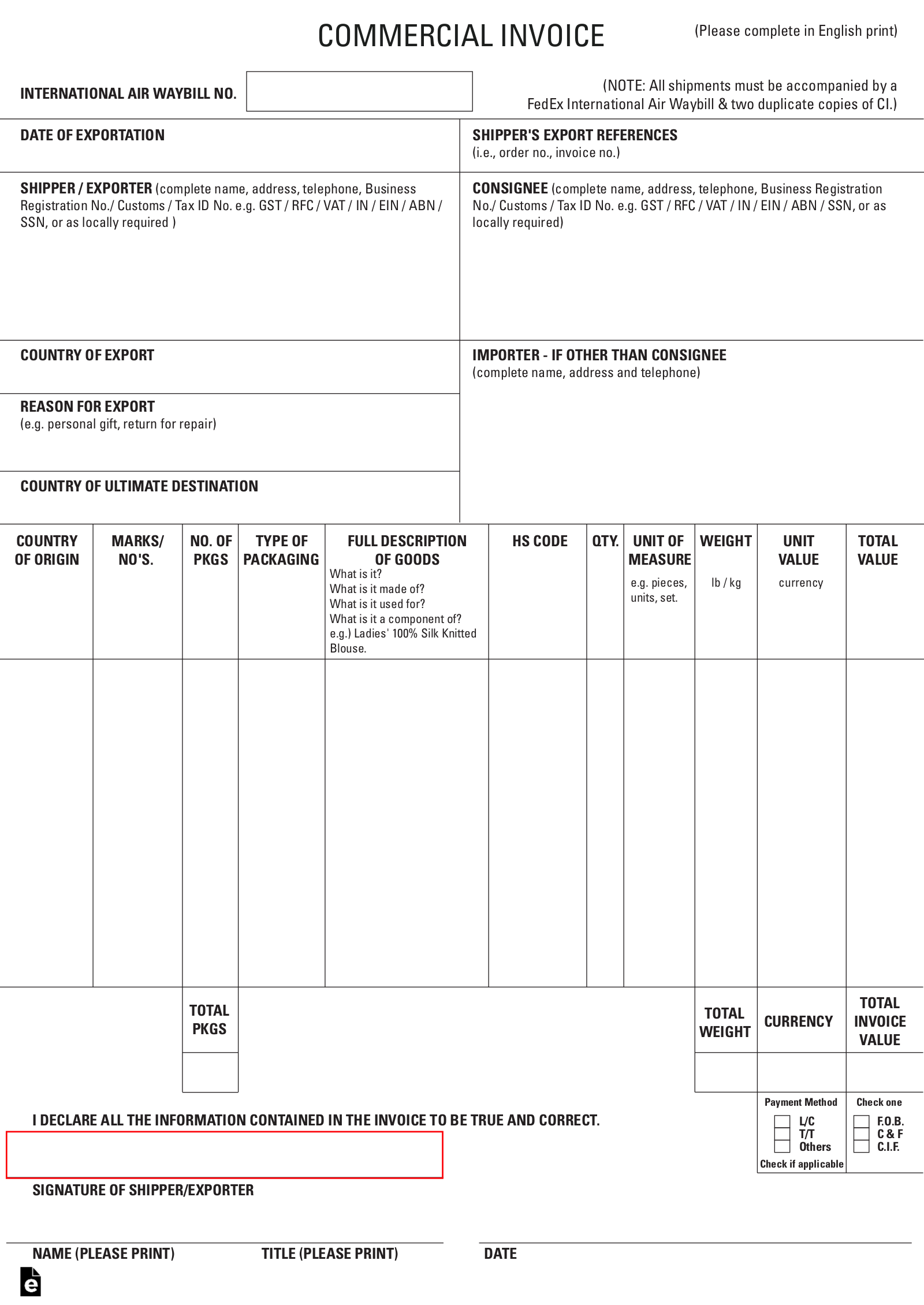

Free International Commercial Invoice Templates - PDF – eForms17 abril 2025

Free International Commercial Invoice Templates - PDF – eForms17 abril 2025 -

AI invoice processing: How to leverage AI in AP Automation17 abril 2025

AI invoice processing: How to leverage AI in AP Automation17 abril 2025 -

Solved: Drill Down on list and AD User Access - Power Platform Community17 abril 2025

-

Partially Pay an Invoice Jane App - Practice Management Software for Health & Wellness Practitioners17 abril 2025

você pode gostar

-

Steam 社区:: Stick Fight: The Game17 abril 2025

Steam 社区:: Stick Fight: The Game17 abril 2025 -

Turkey Hill Dairy17 abril 2025

Turkey Hill Dairy17 abril 2025 -

hu tao in 2023 Tao, Cute profile pictures, Anime images17 abril 2025

hu tao in 2023 Tao, Cute profile pictures, Anime images17 abril 2025 -

Acompanhe as principais notícias do Santo Padre no A1217 abril 2025

Acompanhe as principais notícias do Santo Padre no A1217 abril 2025 -

Ed Edd n' Eddy: Candy Machine Deluxe : Cartoon Network : Free17 abril 2025

Ed Edd n' Eddy: Candy Machine Deluxe : Cartoon Network : Free17 abril 2025 -

The Top Five Most Muscular Hunter X Hunter Characters!17 abril 2025

The Top Five Most Muscular Hunter X Hunter Characters!17 abril 2025 -

Top 3 Idle Mobile Games by Codigames - Odd Statue Games17 abril 2025

Top 3 Idle Mobile Games by Codigames - Odd Statue Games17 abril 2025 -

Locadora TV: Prison Empire Tycoon17 abril 2025

Locadora TV: Prison Empire Tycoon17 abril 2025 -

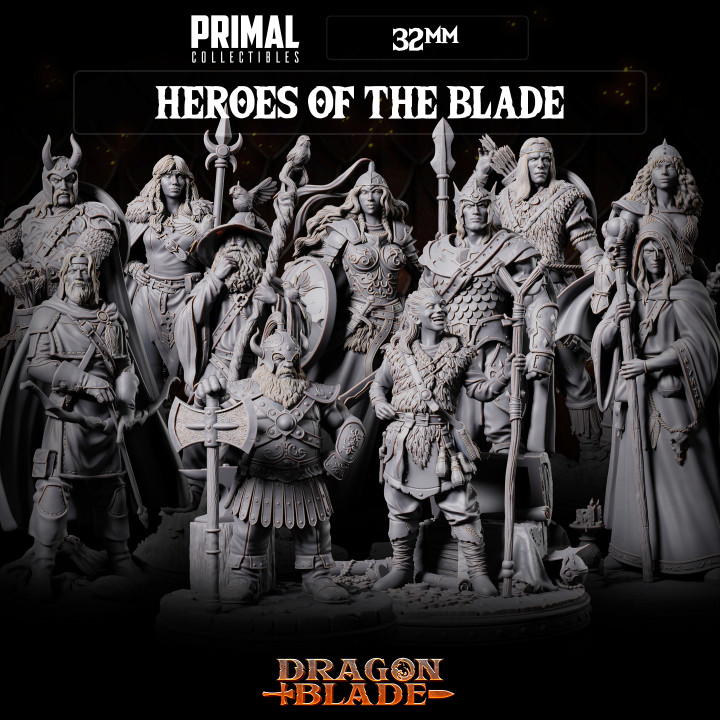

3D Printable 11 miniatures - 32mm - Heroes of the Blade - DRAGONBLADE by PRIMAL Collectibles17 abril 2025

3D Printable 11 miniatures - 32mm - Heroes of the Blade - DRAGONBLADE by PRIMAL Collectibles17 abril 2025 -

Rainha de Katwe (Legendado) – Filmes no Google Play17 abril 2025