Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Last updated 04 abril 2025

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

Mastering Estimated Tax: Minimizing Underpayment Penalties - FasterCapital

What Are the Penalties for Underpaying Estimated Taxes?

Safe Harbor for Underpaying Estimated Tax

How can you avoid or reduce your estimated tax penalties? - Rosenberg Chesnov

IRS Underpayment Penalty of Estimated Taxes & Form 2210 Details

How to Avoid the Underpayment Penalty for Estimated Taxes

Publication 505 (2023), Tax Withholding and Estimated Tax

Estimated Tax Penalty: The Correct Way to Make Estimated Tax Payments for 2021

What Happens If You Miss a Quarterly Estimated Tax Payment?

Common IRS Penalties & How to Avoid Them - Optima Tax Relief

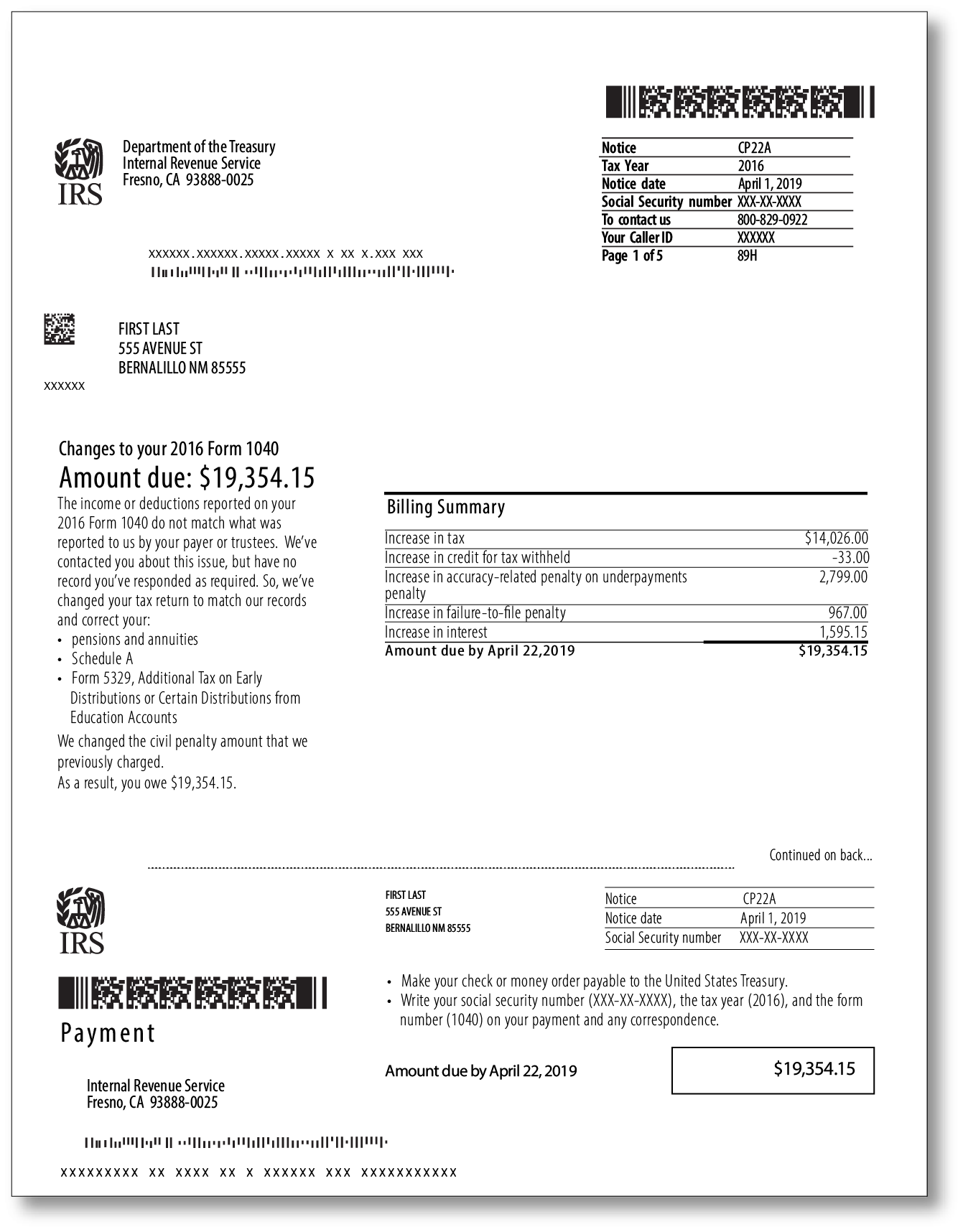

TaxAudit Blog, You got a CP22A

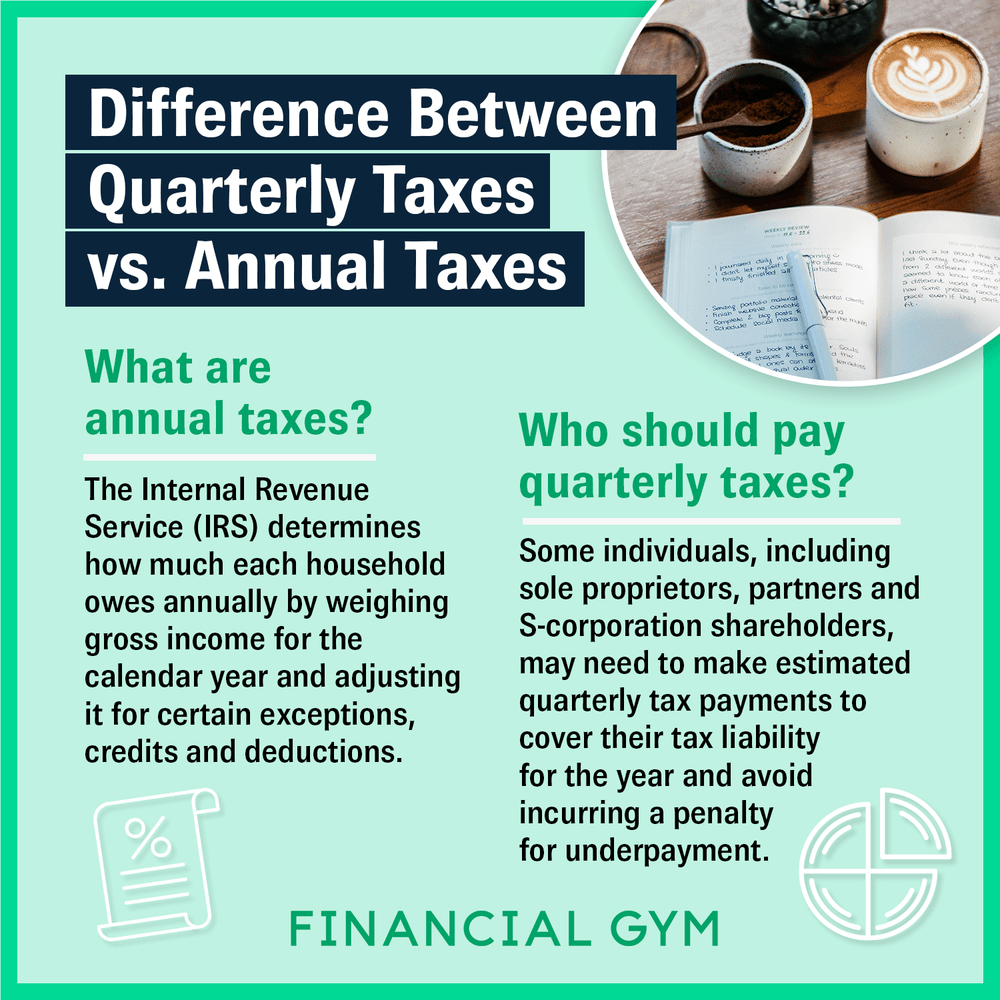

What's the Difference Between Quarterly Taxes vs. Annual Taxes?

Recomendado para você

-

Cristiano Ronaldo asks referee to overturn penalty decision given to him during Asian Champions League game04 abril 2025

Cristiano Ronaldo asks referee to overturn penalty decision given to him during Asian Champions League game04 abril 2025 -

How do penalty shootouts work? Rules of soccer format explained04 abril 2025

How do penalty shootouts work? Rules of soccer format explained04 abril 2025 -

Australia vs. France: NAIL-BITING Penalty Shootout in the 2023 FIFA Women's World Cup Quarterfinals04 abril 2025

Australia vs. France: NAIL-BITING Penalty Shootout in the 2023 FIFA Women's World Cup Quarterfinals04 abril 2025 -

:max_bytes(150000):strip_icc():focal(830x391:832x393)/megan-rapinoe-missed-penalty-080823-1-3467d144959b484d8eb3d7a8a58640cb.jpg) Megan Rapinoe Explains Her Laugh After Missing Penalty Kick in04 abril 2025

Megan Rapinoe Explains Her Laugh After Missing Penalty Kick in04 abril 2025 -

PENALTY SHOOT-OUT definition in American English04 abril 2025

PENALTY SHOOT-OUT definition in American English04 abril 2025 -

Fankaty Dabo: Coventry City condemn racist abuse towards player04 abril 2025

Fankaty Dabo: Coventry City condemn racist abuse towards player04 abril 2025 -

Get Penalty.Kicks04 abril 2025

-

Cristiano Ronaldo breaks Saudi duck with stoppage time penalty to04 abril 2025

-

The 10 Best Panenka Penalties Ever04 abril 2025

The 10 Best Panenka Penalties Ever04 abril 2025 -

England 1-2 France: Kane's penalty miss, Lloris breaks record04 abril 2025

England 1-2 France: Kane's penalty miss, Lloris breaks record04 abril 2025

você pode gostar

-

Unbreakable Phone Hammer's Code & Price - RblxTrade04 abril 2025

-

Pokémon Yellow Detonado #8 - Batalhando Contra o Giovanni e Pegando (Lift Key e Silph Scope)04 abril 2025

Pokémon Yellow Detonado #8 - Batalhando Contra o Giovanni e Pegando (Lift Key e Silph Scope)04 abril 2025 -

GRAB PACK POPPY PLAYTIME (for huggy wuggy)04 abril 2025

-

Shinya Kougami, cg, guy, cigarette, close up, spiky hair, anime04 abril 2025

Shinya Kougami, cg, guy, cigarette, close up, spiky hair, anime04 abril 2025 -

Xadrez Descomplicado: Um Guia Básico para Iniciantes (Xadrez descomplicado para iniciantes) eBook : R, Raphael: : Livros04 abril 2025

Xadrez Descomplicado: Um Guia Básico para Iniciantes (Xadrez descomplicado para iniciantes) eBook : R, Raphael: : Livros04 abril 2025 -

Desenho De Carro Antigo Ligue Os Pontos Um Jogo Números Educativo Para Crianças Vetor PNG , Desenho De Gato, Desenho De Carro, Desenho Educacional Imagem PNG e Vetor Para Download Gratuito04 abril 2025

Desenho De Carro Antigo Ligue Os Pontos Um Jogo Números Educativo Para Crianças Vetor PNG , Desenho De Gato, Desenho De Carro, Desenho Educacional Imagem PNG e Vetor Para Download Gratuito04 abril 2025 -

![LIGHT NOVEL VOLUME 15 DE DANMACHI [RESUMO] CAPÍTULO 1/ PARTE 1 [DUNGEON NI DEAI]](https://i.ytimg.com/vi/8kjXXoHneRg/maxresdefault.jpg) LIGHT NOVEL VOLUME 15 DE DANMACHI [RESUMO] CAPÍTULO 1/ PARTE 1 [DUNGEON NI DEAI]04 abril 2025

LIGHT NOVEL VOLUME 15 DE DANMACHI [RESUMO] CAPÍTULO 1/ PARTE 1 [DUNGEON NI DEAI]04 abril 2025 -

Caminhão Truck Vermelho com Pedal e Capacete - 9300C- Magic Toys - Real Brinquedos04 abril 2025

Caminhão Truck Vermelho com Pedal e Capacete - 9300C- Magic Toys - Real Brinquedos04 abril 2025 -

hahahahaha Memes & GIFs - Imgflip04 abril 2025

hahahahaha Memes & GIFs - Imgflip04 abril 2025 -

Kemono Michi: Rise Up (2019)04 abril 2025

Kemono Michi: Rise Up (2019)04 abril 2025