How previous home sales might affect your capital gains taxes - Los Angeles Times

Por um escritor misterioso

Last updated 16 abril 2025

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

Rules on home sale gains changed in 1997. But there's a chance that a previous sale could alter how much you can defer now if you sell. Here's how.

12 Tax-Smart Charitable Giving Tips for 2023

How bank bonuses and interest payouts affect your tax bill - Los Angeles Times

Tax implications of selling a home after 55 - FasterCapital

Editorial: L.A. 'mansion tax' to ease homelessness is in limbo - Los Angeles Times

Selling Your Residence and the Capital Gains Exclusion - Russo Law Group

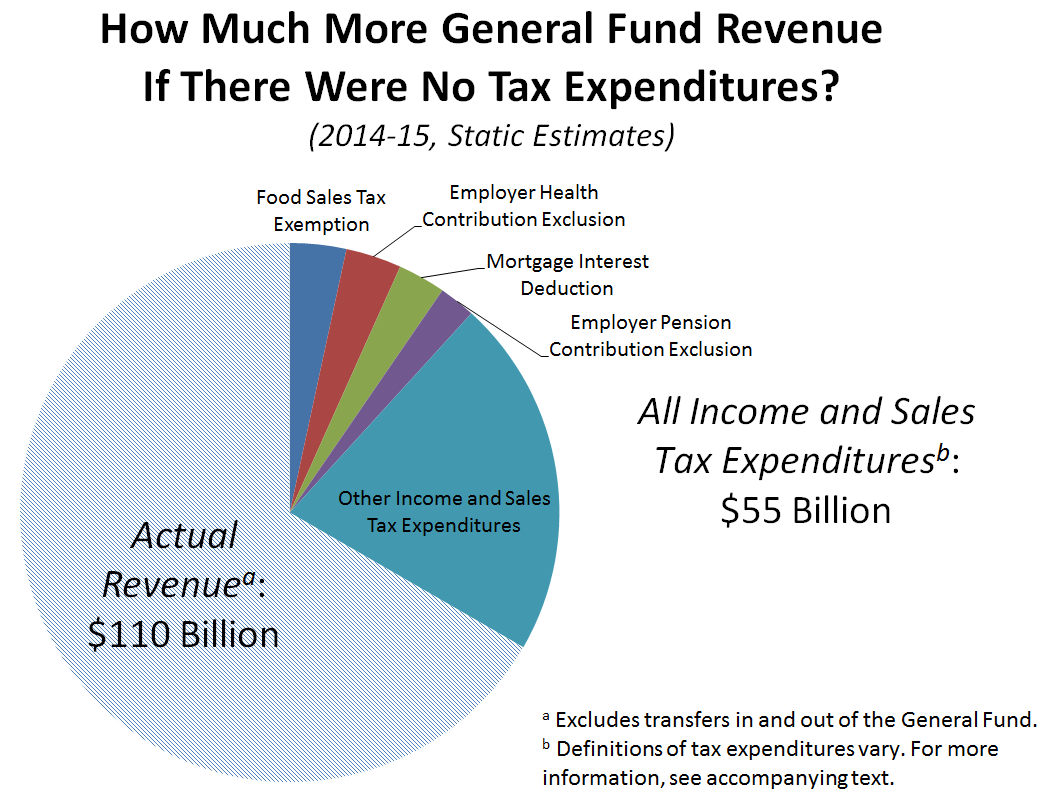

California State Tax Expenditures Total Around $55 Billion [EconTax Blog]

How Much Tax Do You Pay When You Sell Your House in California

Stop worrying, NIMBYS — affordable housing shouldn't squash property values - Los Angeles Times

Home Sale Exclusion: Tax Savings on Capital Gain of a Principal Residence

Recomendado para você

-

HOME with Dean Sharp, The House Whisperer16 abril 2025

-

WHY – We Hear You16 abril 2025

WHY – We Hear You16 abril 2025 -

Who will care for you when you are elderly and frail? You should plan now16 abril 2025

Who will care for you when you are elderly and frail? You should plan now16 abril 2025 -

BinaxNOW: What You Need to Know16 abril 2025

BinaxNOW: What You Need to Know16 abril 2025 -

This young Seattle couple rushed to buy a $730K home — and now they can't16 abril 2025

-

Then vs. now: Kevin's total grocery bill today from 'Home Alone' may shock you16 abril 2025

Then vs. now: Kevin's total grocery bill today from 'Home Alone' may shock you16 abril 2025 -

You Can Now Rent The Home Alone House via Airbnb16 abril 2025

You Can Now Rent The Home Alone House via Airbnb16 abril 2025 -

:max_bytes(150000):strip_icc()/GettyImages-1282134200-0d6e9a21f5174482a9327e1db4fa677a.jpg) How to Cut Your Alternative Minimum Tax16 abril 2025

How to Cut Your Alternative Minimum Tax16 abril 2025 -

The paramedic will see you now: home visits by ambulance staff lighten GPs' load, NHS16 abril 2025

The paramedic will see you now: home visits by ambulance staff lighten GPs' load, NHS16 abril 2025 -

Mortgage rates are falling. Should you refinance your home now? - CBS News16 abril 2025

Mortgage rates are falling. Should you refinance your home now? - CBS News16 abril 2025

você pode gostar

-

Subwaysurferskeys Stories - Wattpad16 abril 2025

Subwaysurferskeys Stories - Wattpad16 abril 2025 -

Lasertag transparent background PNG cliparts free download16 abril 2025

Lasertag transparent background PNG cliparts free download16 abril 2025 -

Tik tok fortnite streamer starter pack : r/starterpacks16 abril 2025

Tik tok fortnite streamer starter pack : r/starterpacks16 abril 2025 -

Sport Club Corinthians Paulista - Wikipedia16 abril 2025

Sport Club Corinthians Paulista - Wikipedia16 abril 2025 -

Nunca quis jogar bola - Por Leandro Marçal - Coluna De Letra16 abril 2025

Nunca quis jogar bola - Por Leandro Marçal - Coluna De Letra16 abril 2025 -

Anime: Lv1 Maou to One Room Yuusha #anime #foryou #foryoupage #fyp #fy16 abril 2025

-

Selective Focus Vegetable Shallot Scientific Name Stock Photo 231163025916 abril 2025

Selective Focus Vegetable Shallot Scientific Name Stock Photo 231163025916 abril 2025 -

American McGee to retire from the video game industry after Alice16 abril 2025

American McGee to retire from the video game industry after Alice16 abril 2025 -

Poki Ad16 abril 2025

Poki Ad16 abril 2025 -

Funko on X: Popapalooza 2022: POP! Television: South Park™ - South Park™ Boy Band. Pre-order today! #FunkoPopapalooza #Funko #FunkoPOP : South Park™ Shop: / X16 abril 2025

Funko on X: Popapalooza 2022: POP! Television: South Park™ - South Park™ Boy Band. Pre-order today! #FunkoPopapalooza #Funko #FunkoPOP : South Park™ Shop: / X16 abril 2025