What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand

Por um escritor misterioso

Last updated 14 abril 2025

FICA taxes are withheld from an employee’s paycheck and collected by the federal government to help pay for Social Security and Medicare.

What Is FICA Tax? A Guide to FICA Taxes for Business Owners (2023) - Shopify New Zealand

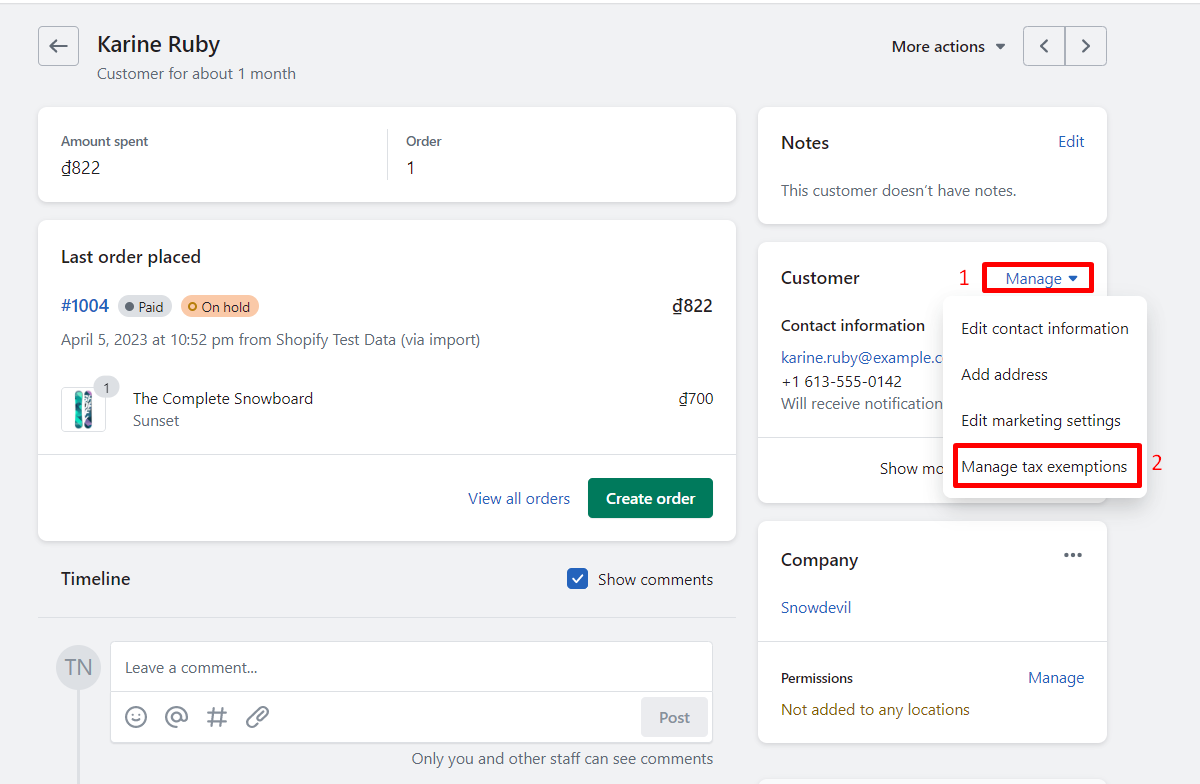

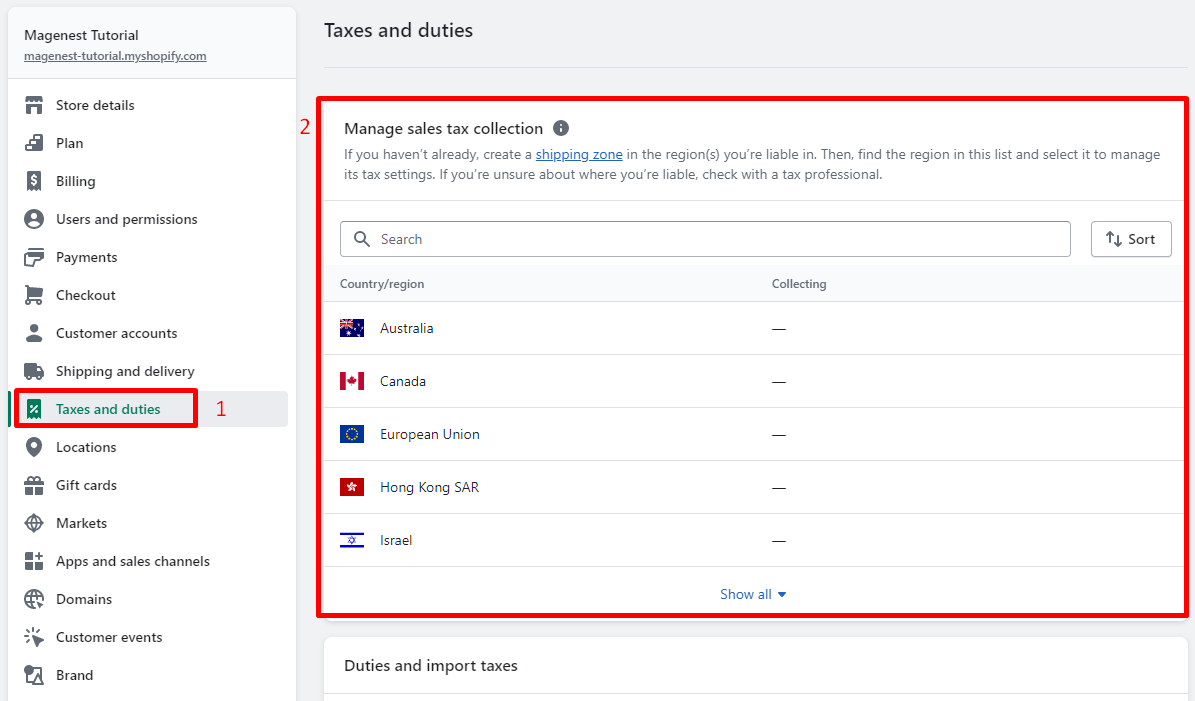

Shopify Taxes: A Comprehensive Guide to Understanding in 2023

Tax Deductions Cheat Sheet for 2024 - FreshBooks

A Guide to Benefit in Kind Tax Around the World - Boundless

FICA Tax in 2022-2023: What Small Businesses Need to Know

What You Need To Know About Self-Employment Tax (2023)

Tax Deductions Cheat Sheet for 2024 - FreshBooks

Shopify Pricing in New Zealand NZ 2023

Shopify Taxes: A Comprehensive Guide to Understanding in 2023

Shopify Taxes: A Comprehensive Guide to Understanding in 2023

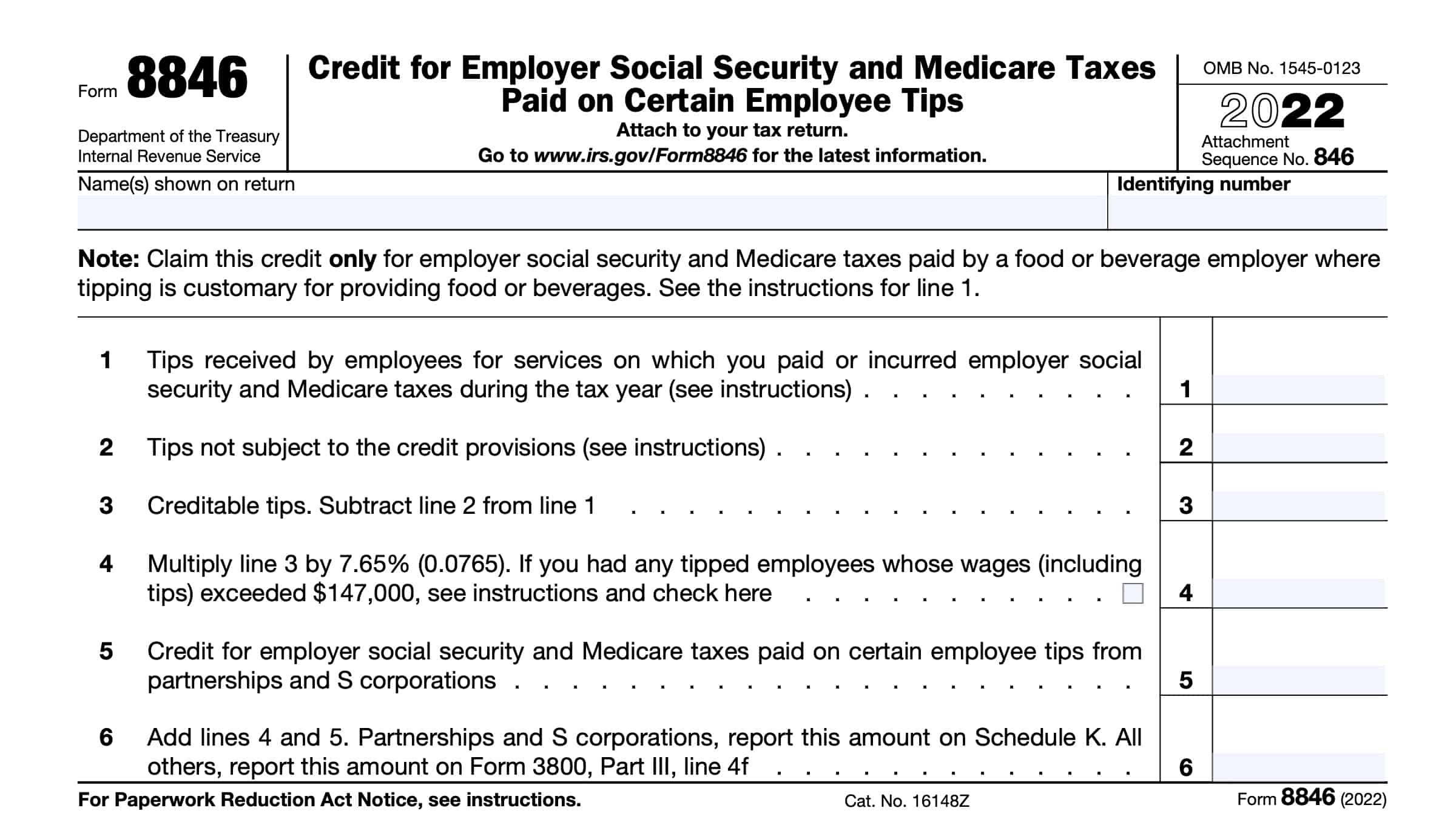

IRS Form 8846 Instructions: Credit for Employer Taxes Paid on Tips

Recomendado para você

-

FICA Tax: What It is and How to Calculate It14 abril 2025

-

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks14 abril 2025

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks14 abril 2025 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays14 abril 2025

Federal Insurance Contributions Act (FICA): What It Is, Who Pays14 abril 2025 -

What is the FICA Tax and How Does it Connect to Social Security?14 abril 2025

-

What is a payroll tax?, Payroll tax definition, types, and employer obligations14 abril 2025

What is a payroll tax?, Payroll tax definition, types, and employer obligations14 abril 2025 -

2021 FICA Tax Rates14 abril 2025

-

FICA explained: Social Security and Medicare tax rates to know in 202314 abril 2025

FICA explained: Social Security and Medicare tax rates to know in 202314 abril 2025 -

How Do I Get a FICA Tax Refund for F1 Students?14 abril 2025

How Do I Get a FICA Tax Refund for F1 Students?14 abril 2025 -

2019 US Tax Season in Numbers for Sprintax Customers14 abril 2025

2019 US Tax Season in Numbers for Sprintax Customers14 abril 2025 -

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons14 abril 2025

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons14 abril 2025

você pode gostar

-

Hobbit - Entering The Realm Ropa y accesorios para fans de merch14 abril 2025

Hobbit - Entering The Realm Ropa y accesorios para fans de merch14 abril 2025 -

![Ghost Of Tsushima: Directors Cut for PlayStation 5 [PS5] (PS5)](https://m.media-amazon.com/images/W/MEDIAX_792452-T2/images/I/81I2oRdAqLL._AC_UF1000,1000_QL80_.jpg) Ghost Of Tsushima: Directors Cut for PlayStation 5 [PS5] (PS5)14 abril 2025

Ghost Of Tsushima: Directors Cut for PlayStation 5 [PS5] (PS5)14 abril 2025 -

Oiles SPB-405030 Box of 4 Straight Bushing - 40 mm ID - IMS Supply14 abril 2025

-

Clothing thumbnails appear blank on site and when loaded in game14 abril 2025

Clothing thumbnails appear blank on site and when loaded in game14 abril 2025 -

The Eminence in Shadow está en Crunchyroll? Te explico dónde ver el anime al completo14 abril 2025

The Eminence in Shadow está en Crunchyroll? Te explico dónde ver el anime al completo14 abril 2025 -

Integração contínua e a entrega contínua (CI/CD) no GitLAB - O caso de um Backend NodeJS - TerraLAB14 abril 2025

Integração contínua e a entrega contínua (CI/CD) no GitLAB - O caso de um Backend NodeJS - TerraLAB14 abril 2025 -

Gabimaru icon Personagens de anime, Anime, Desenhos de anime14 abril 2025

Gabimaru icon Personagens de anime, Anime, Desenhos de anime14 abril 2025 -

The Backrooms: Liminal Reality on Steam14 abril 2025

The Backrooms: Liminal Reality on Steam14 abril 2025 -

Jogo minecraft playstation 3 original14 abril 2025

Jogo minecraft playstation 3 original14 abril 2025 -

Super Street Fighter IV: Arcade Edition - Playstation 314 abril 2025

Super Street Fighter IV: Arcade Edition - Playstation 314 abril 2025