Online gaming industry for 28% GST on gross gaming revenue not on entry amount

Por um escritor misterioso

Last updated 07 abril 2025

GGR is the fee charged by an online skill gaming platform as service charges to facilitate the participation of players in a game on their platform while Contest Entry Amount (CEA) is the entire amount deposited by the player to enter a contest on the platform.

Navigating The Future: GST Challenges And Opportunities In India's

Implementation of 28% GST rate will bring challenges to online

Online gaming industry for 28% GST on gross gaming revenue not on

Indian government's decision to impose 28% GST on Online Gaming

)

Online gaming industry agrees for 28% GST only on GGR not on entry

Guide to Online Gaming in India🃏🎰 - by Jia - JJ Tax Blog

28% GST on online gaming 'unconstitutional', will lead to job

GST Council decides to levy 28% tax on online gaming, horse racing

Online Gaming Industry Calls For Levying GST Only On GGR

Storyboard18 GST of 28% on online gaming would put survival of

Recomendado para você

-

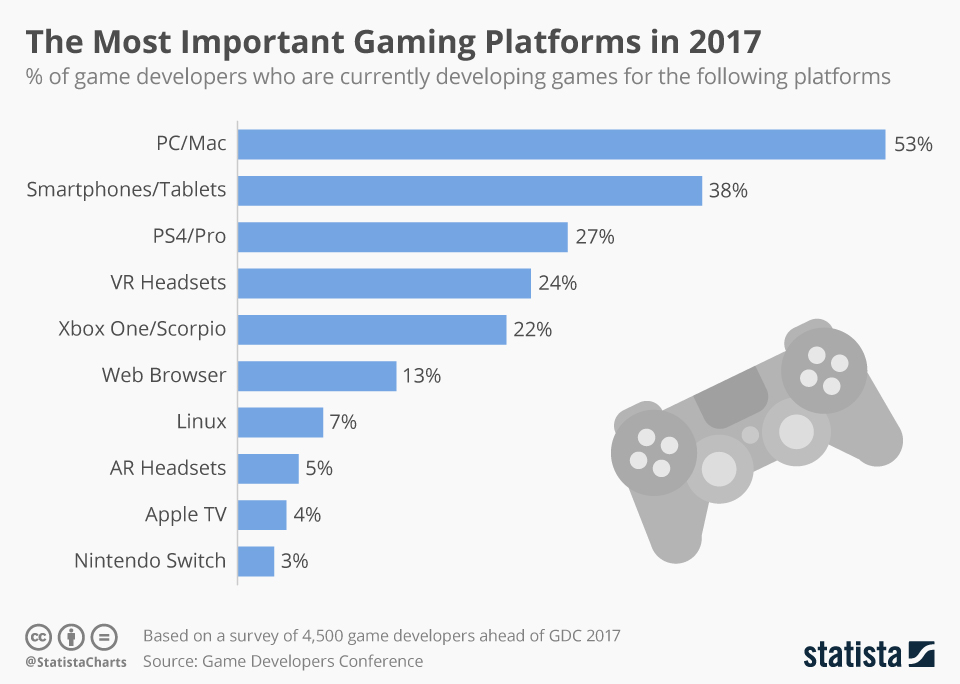

Chart: The Most Important Gaming Platforms 201707 abril 2025

Chart: The Most Important Gaming Platforms 201707 abril 2025 -

Gaming Platform Services for IGT - Sigma Software07 abril 2025

Gaming Platform Services for IGT - Sigma Software07 abril 2025 -

Use case: How Qrator Labs Responded to DDoS Challenges in the Online Game Platform.07 abril 2025

-

Cloud Gaming. Gaming on Demand, Video and File Streaming, Cloud Technology, Various Devices Game, Online Platform, AI Gaming Stock Illustration - Illustration of cloud, backend: 19887232407 abril 2025

Cloud Gaming. Gaming on Demand, Video and File Streaming, Cloud Technology, Various Devices Game, Online Platform, AI Gaming Stock Illustration - Illustration of cloud, backend: 19887232407 abril 2025 -

explores online gaming for its platform - Neowin07 abril 2025

explores online gaming for its platform - Neowin07 abril 2025 -

Gaming addiction. Man bearded hipster gamer headphones and keyboard. Play computer games. Online gaming platform. Gaming modern leisure. Cyber sport arena. Gaming PC build guide. Graphics settings Stock Photo by ©stetsik 51056504407 abril 2025

Gaming addiction. Man bearded hipster gamer headphones and keyboard. Play computer games. Online gaming platform. Gaming modern leisure. Cyber sport arena. Gaming PC build guide. Graphics settings Stock Photo by ©stetsik 51056504407 abril 2025 -

Cloud gaming abstract concept vector illustration. Gaming on demand, video and file streaming, cloud technology, various devices game, online platform, AI gaming solution abstract metaphor Stock Vector Image & Art - Alamy07 abril 2025

Cloud gaming abstract concept vector illustration. Gaming on demand, video and file streaming, cloud technology, various devices game, online platform, AI gaming solution abstract metaphor Stock Vector Image & Art - Alamy07 abril 2025 -

Happy Halloween: Gaming platform Roblox is back online after fiasco07 abril 2025

Happy Halloween: Gaming platform Roblox is back online after fiasco07 abril 2025 -

How to win real money online? 5 best gaming sites 2022 - The Economic Times07 abril 2025

How to win real money online? 5 best gaming sites 2022 - The Economic Times07 abril 2025 -

Twitch and Beyond: The Best Video Game Live Streaming Services for07 abril 2025

Twitch and Beyond: The Best Video Game Live Streaming Services for07 abril 2025

você pode gostar

-

Slime Rancher 2 Nectar guide: How to get the Jetpack for more Moondew Nectar07 abril 2025

Slime Rancher 2 Nectar guide: How to get the Jetpack for more Moondew Nectar07 abril 2025 -

Koi to Yobu ni wa Kimochi Warui Anime Premieres on April 5, Manga07 abril 2025

Koi to Yobu ni wa Kimochi Warui Anime Premieres on April 5, Manga07 abril 2025 -

Opila Bird from Garten Of Banban Fan Art07 abril 2025

Opila Bird from Garten Of Banban Fan Art07 abril 2025 -

The Gryphon - Rotten Tomatoes07 abril 2025

The Gryphon - Rotten Tomatoes07 abril 2025 -

Humble Royalty Free RPG Game Development Asset Bundle –07 abril 2025

Humble Royalty Free RPG Game Development Asset Bundle –07 abril 2025 -

Re-ment Hunter x Hunter New Adventure Gon Killua Biscuit Chrollo07 abril 2025

Re-ment Hunter x Hunter New Adventure Gon Killua Biscuit Chrollo07 abril 2025 -

Take-Two CEO says the $50 price tag on the multiplayer-free PS407 abril 2025

Take-Two CEO says the $50 price tag on the multiplayer-free PS407 abril 2025 -

Lucky, Google Doodles Wiki07 abril 2025

Lucky, Google Doodles Wiki07 abril 2025 -

My Review of Every Flavor of Cheetos Mac 'n Cheese - Delishably07 abril 2025

My Review of Every Flavor of Cheetos Mac 'n Cheese - Delishably07 abril 2025 -

Comprar Saia tubo pelinhos xadrez rosa pink - DOS PÉS À CABEÇA07 abril 2025

Comprar Saia tubo pelinhos xadrez rosa pink - DOS PÉS À CABEÇA07 abril 2025