Requesting FICA Tax Refunds For W2 Employees With Multiple Employers

Por um escritor misterioso

Last updated 06 abril 2025

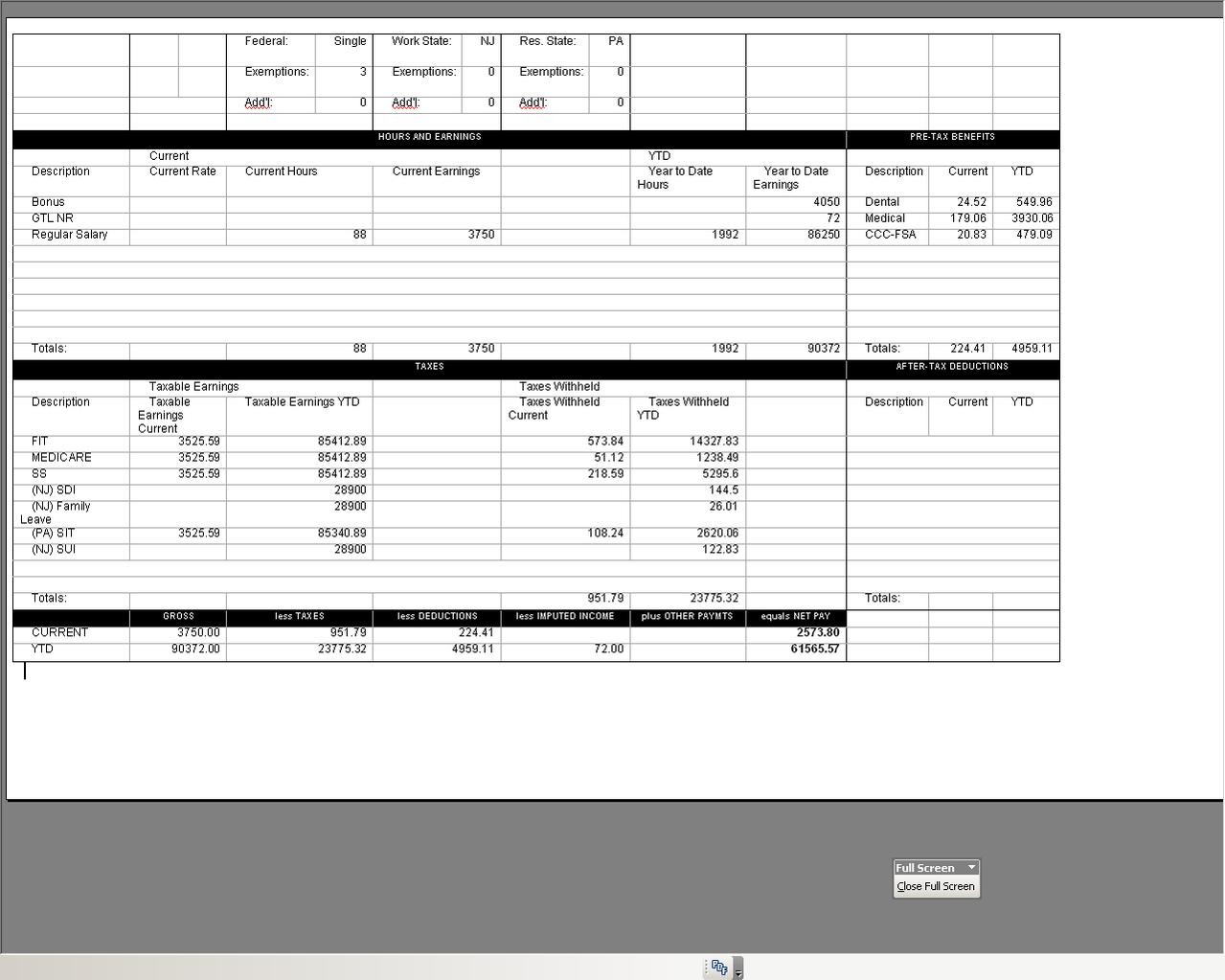

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax ove

1099, W-9, W-2, W-4: A guide to the tax forms and who fills them out

W2 Tax Forms & Envelopes for 2023 - Discount Tax Forms

Beyond Numbers: FICA: s Impact on Your W 2 Form - FasterCapital

1099 vs W-2: What's the difference?

W2 FAQ: TurboTax says I need a corrected W2 - ASAP Help Center

What Is the FICA Tax Refund? —

What to Do When Employee Withholding Is Incorrect - CPA Practice

Form W-2 Wage and Tax Statement: What It Is and How to Read It

How to Fill Out a W-2 Form丨PDF Reader Pro

Recomendado para você

-

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks06 abril 2025

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks06 abril 2025 -

Important 2020 Federal Tax Deadlines for Small Businesses - Workest06 abril 2025

Important 2020 Federal Tax Deadlines for Small Businesses - Workest06 abril 2025 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays06 abril 2025

Federal Insurance Contributions Act (FICA): What It Is, Who Pays06 abril 2025 -

What are FICA Tax Payable? – SuperfastCPA CPA Review06 abril 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review06 abril 2025 -

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet06 abril 2025

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet06 abril 2025 -

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents06 abril 2025

FICA Tax Refund Timeline - About 6 Months with Employer Letter and Required Documents06 abril 2025 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations06 abril 2025

What is a payroll tax?, Payroll tax definition, types, and employer obligations06 abril 2025 -

The FICA Tax: How Social Security Is Funded – Social Security Intelligence06 abril 2025

The FICA Tax: How Social Security Is Funded – Social Security Intelligence06 abril 2025 -

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg) What Is Social Security Tax? Definition, Exemptions, and Example06 abril 2025

What Is Social Security Tax? Definition, Exemptions, and Example06 abril 2025 -

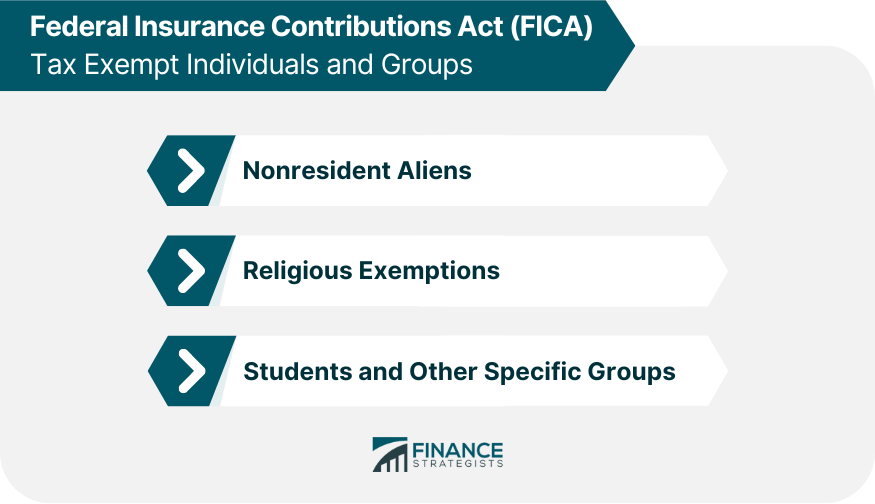

Federal Insurance Contributions Act (FICA)06 abril 2025

Federal Insurance Contributions Act (FICA)06 abril 2025

você pode gostar

-

![MAD]Anne and her friend Grea<Manaria Friends> - BiliBili](https://pic.bstarstatic.com/ugc/3efd5d52f02694f9485582e7629b3867.jpeg) MAD]Anne and her friend Grea

MAD]Anne and her friend Grea- BiliBili 06 abril 2025 -

More finished Sonic.exe concept art : r/FridayNightFunkin06 abril 2025

More finished Sonic.exe concept art : r/FridayNightFunkin06 abril 2025 -

FNAF 13.8 DJ Music Man Plush Doll DJMM Stuffed Game Spider Doll06 abril 2025

FNAF 13.8 DJ Music Man Plush Doll DJMM Stuffed Game Spider Doll06 abril 2025 -

Quantas pessoas jogam Free Fire? Tudo que você precisa saber06 abril 2025

Quantas pessoas jogam Free Fire? Tudo que você precisa saber06 abril 2025 -

cn.i.cdn.ti-platform.com/content/1339/fanart---ben06 abril 2025

cn.i.cdn.ti-platform.com/content/1339/fanart---ben06 abril 2025 -

PlayStation Store divulga os jogos mais baixados em setembro de06 abril 2025

-

Minecraft & Spatial Building Momentum: Implications for Geodesign06 abril 2025

Minecraft & Spatial Building Momentum: Implications for Geodesign06 abril 2025 -

Sasuke Uchiha Poster | Exclusive Art | Naruto Shippuden | NEW | USA06 abril 2025

Sasuke Uchiha Poster | Exclusive Art | Naruto Shippuden | NEW | USA06 abril 2025 -

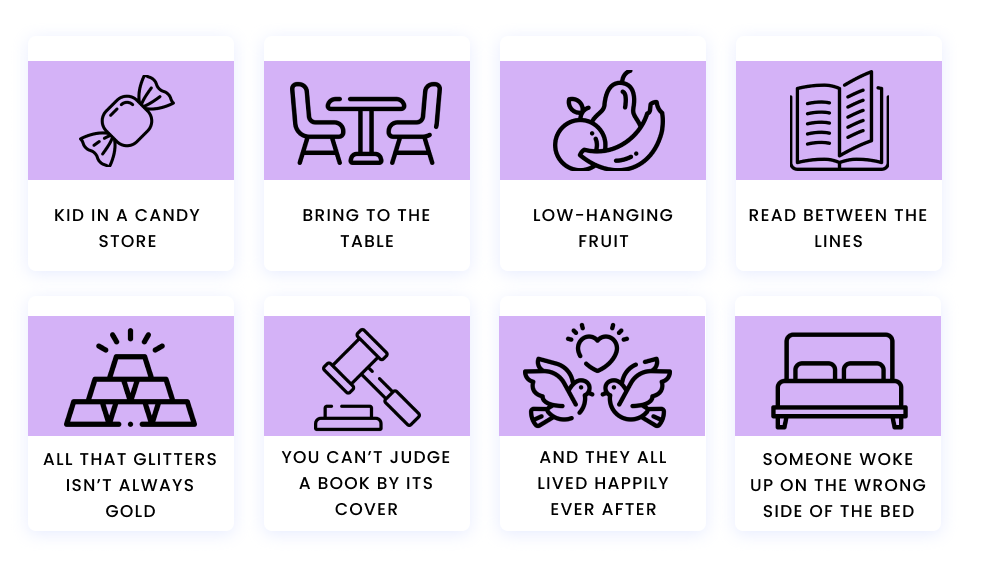

Clichés: definition, examples, how to use them - Writer06 abril 2025

Clichés: definition, examples, how to use them - Writer06 abril 2025 -

The World's Hardest Game: All about The World's Hardest Game06 abril 2025

The World's Hardest Game: All about The World's Hardest Game06 abril 2025