What Eliminating FICA Tax Means for Your Retirement

Por um escritor misterioso

Last updated 25 abril 2025

A recent poll out said that over 60% of current retirees are relying on social security and Medicare for a majority of their income in retirement. So while getting rid of FICA tax sounds nice now because nobody likes paying taxes, it could be detrimental not just to retirees or when you can retire

Social Security Offsets – LASERS

Medicare & Social Security Reform: US Debt & Deficit Crisis

PERA and Social Security - PERA On The Issues

Program Explainer: Government Pension Offset

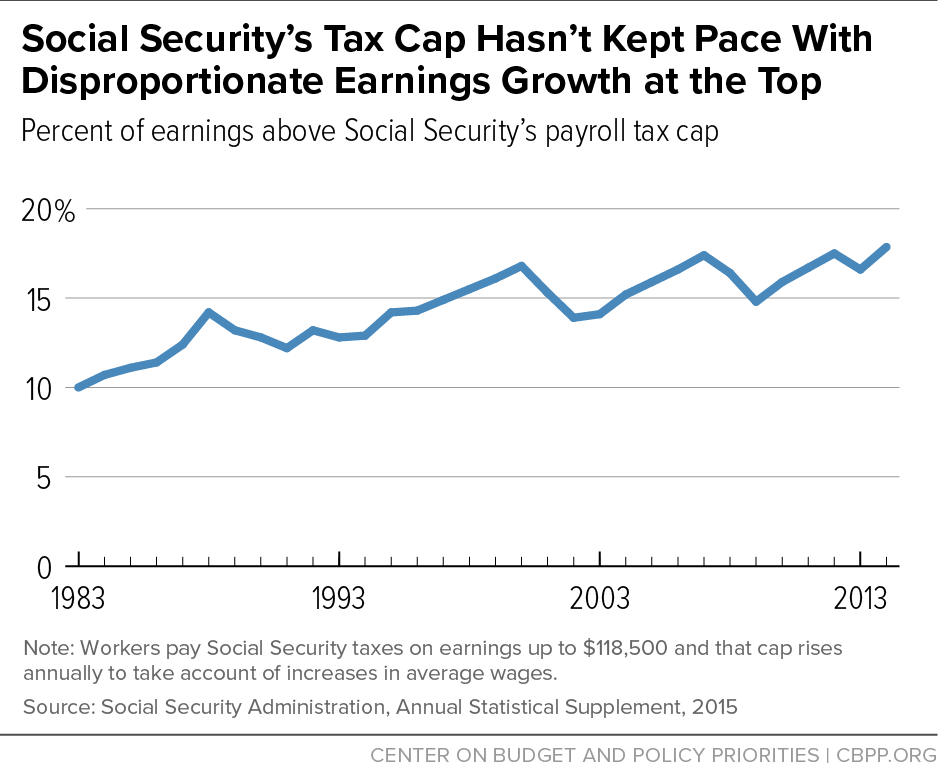

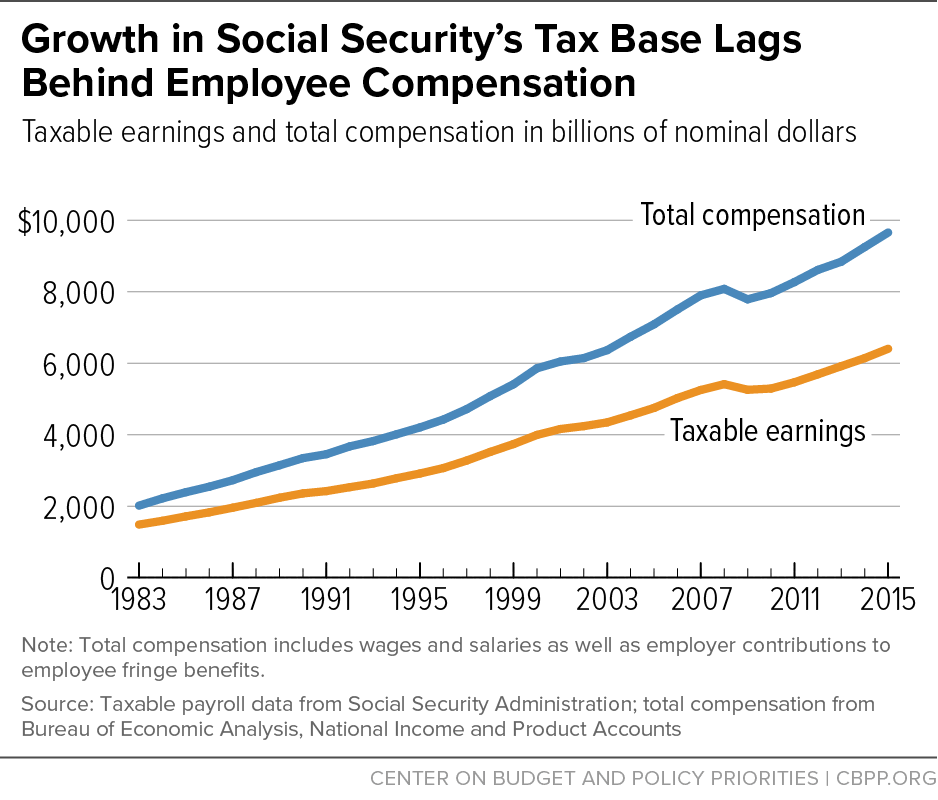

Increasing Payroll Taxes Would Strengthen Social Security

Who Is Exempt From Social Security Taxes? - SmartAsset

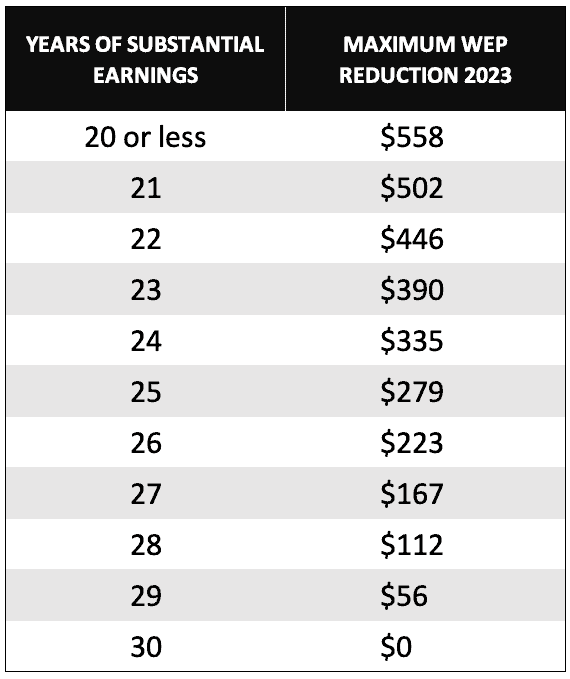

The Best Explanation of the Windfall Elimination Provision (2023 Update) – Social Security Intelligence

Tax Tips for Retirement - TurboTax Tax Tips & Videos

House Republicans Propose Exempting Social Security Benefits From Income Tax

2022 Wage Cap Jumps to $147,000 for Social Security Payroll Taxes

Increasing Payroll Taxes Would Strengthen Social Security

States That Won't Tax Your Federal Retirement Income - Government Executive

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

Recomendado para você

-

What is FICA tax?25 abril 2025

What is FICA tax?25 abril 2025 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks25 abril 2025

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks25 abril 2025 -

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg) Federal Insurance Contributions Act (FICA): What It Is, Who Pays25 abril 2025

Federal Insurance Contributions Act (FICA): What It Is, Who Pays25 abril 2025 -

Social Security Administration - “What is FICA on my paycheck?” Find out25 abril 2025

-

FICA Tax: Understanding Social Security and Medicare Taxes25 abril 2025

-

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student25 abril 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student25 abril 2025 -

Understanding FICA Taxes and Wage Base Limit25 abril 2025

Understanding FICA Taxes and Wage Base Limit25 abril 2025 -

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books25 abril 2025

How to FICA Tax and Tax Withholding Work in 2021-2022 - Reconcile Books25 abril 2025 -

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons25 abril 2025

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons25 abril 2025 -

FICA TAX PROVISIONS (1967-1980)25 abril 2025

FICA TAX PROVISIONS (1967-1980)25 abril 2025

você pode gostar

-

Fundo Prato Marrom Assado De Fígado De Frango Frito Foto E Imagem Para Download Gratuito - Pngtree25 abril 2025

Fundo Prato Marrom Assado De Fígado De Frango Frito Foto E Imagem Para Download Gratuito - Pngtree25 abril 2025 -

BN Rivers WK.doc - Name: Bill Nye: Rivers and Streams 1. What does25 abril 2025

BN Rivers WK.doc - Name: Bill Nye: Rivers and Streams 1. What does25 abril 2025 -

Usuários agora vão poder gerar experiências e produtos no Roblox25 abril 2025

Usuários agora vão poder gerar experiências e produtos no Roblox25 abril 2025 -

A Fazenda: Enquete mostra quem sai e traz reviravolta em votação parcial · Notícias da TV25 abril 2025

A Fazenda: Enquete mostra quem sai e traz reviravolta em votação parcial · Notícias da TV25 abril 2025 -

Category:Characters, Hataraku Maou-sama! Wiki25 abril 2025

Category:Characters, Hataraku Maou-sama! Wiki25 abril 2025 -

Hunt Showdown25 abril 2025

Hunt Showdown25 abril 2025 -

Dragon Age: Origins, Dragon Age Wiki25 abril 2025

Dragon Age: Origins, Dragon Age Wiki25 abril 2025 -

Sony - PlayStation 5 Digital Edition – Horizon Forbidden West25 abril 2025

Sony - PlayStation 5 Digital Edition – Horizon Forbidden West25 abril 2025 -

/i.s3.glbimg.com/v1/AUTH_bc8228b6673f488aa253bbcb03c80ec5/internal_photos/bs/2022/L/g/pLrL6hQpuONApNBmXORw/fifa-22-lidera-ranking-jogos-esports-twitch.png) FIFA 22 lidera entre jogos de esporte mais vistos da Twitch, fifa25 abril 2025

FIFA 22 lidera entre jogos de esporte mais vistos da Twitch, fifa25 abril 2025 -

Marvel Legends Doctor Octopus Toybiz Action Figure - Spider Man 225 abril 2025

Marvel Legends Doctor Octopus Toybiz Action Figure - Spider Man 225 abril 2025