Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Last updated 31 março 2025

:max_bytes(150000):strip_icc()/independent-contractor.asp-FINAL-6904c017dfbf4da18e90cf4db4af91e7.png)

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

Guide to Taxes for Independent Contractors (2023)

How to file W-2 and 1099 together: Tax guide for 2024

What can independent contractors deduct?

A Guide to Independent Contractor Taxes - Ramsey

What is an Independent Contractor? Are They Employees?

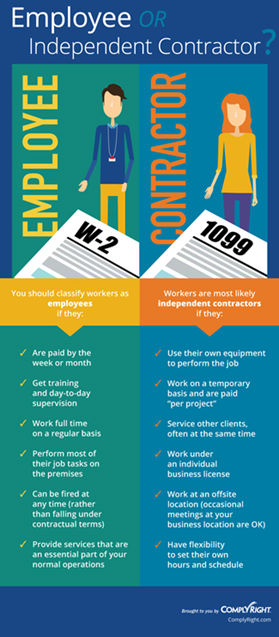

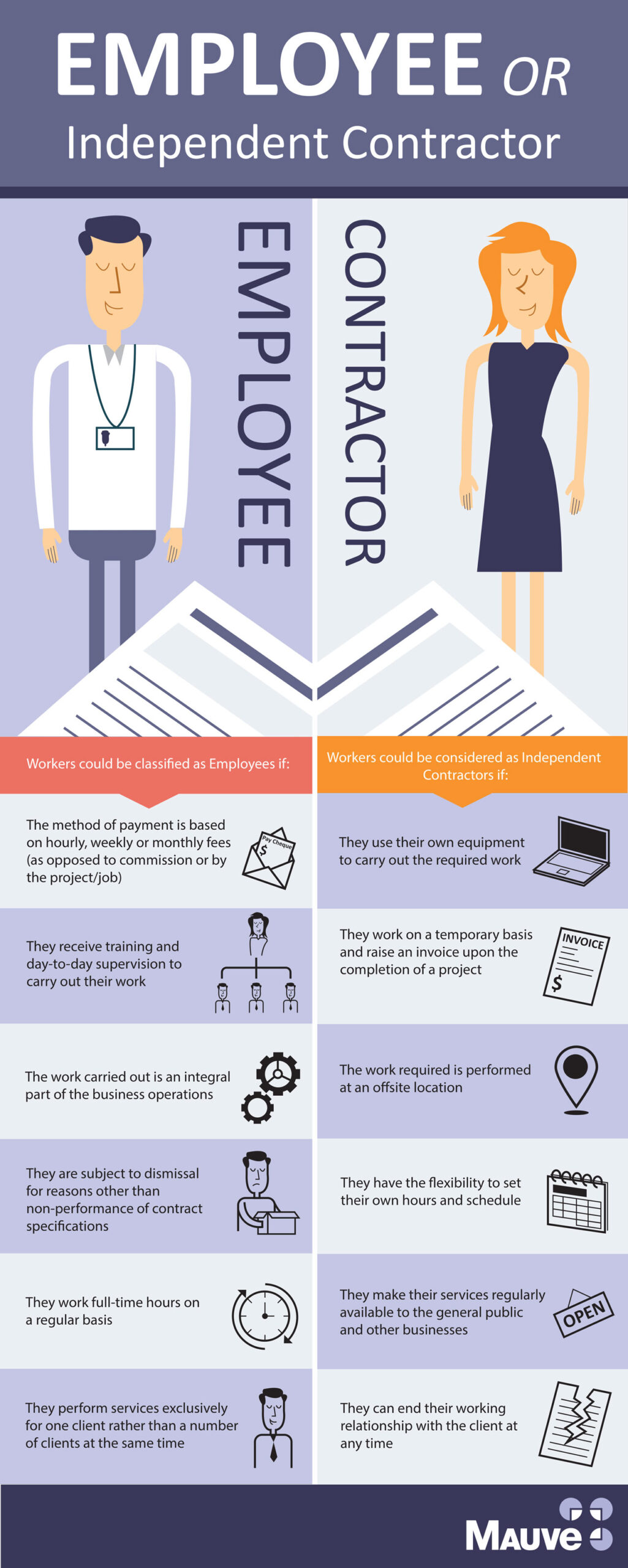

Independent Contractor vs Employee - Top 8 Differences (Infographic)

Easy Guide to Independent Contractor Taxes: California Edition

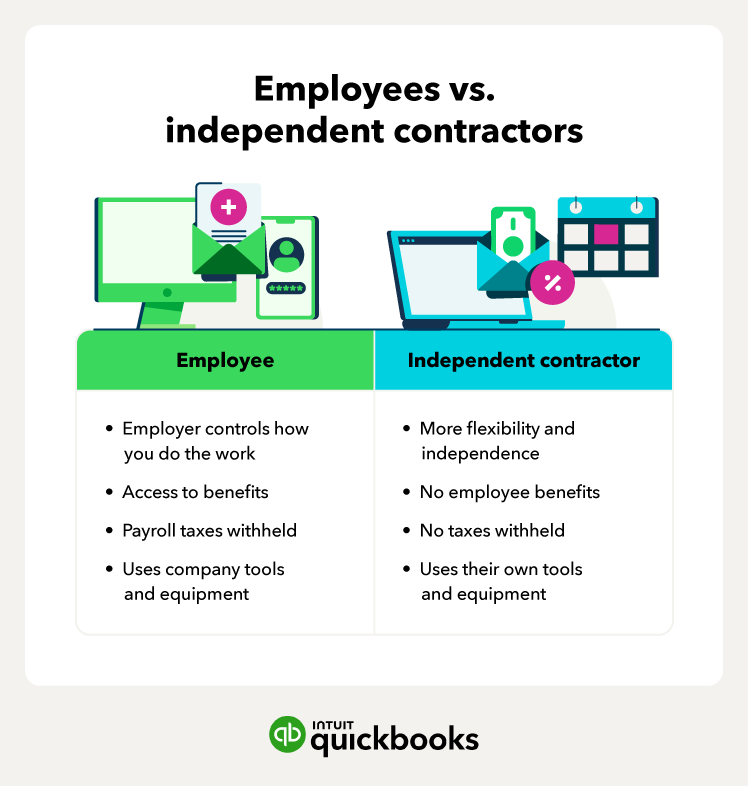

What are the differences between employees and independent

How Much Should I Save for 1099 Taxes? [Free Self-Employment

Guide to Independent Contractor Jobs: Gigs and Freelance Jobs

Texas Independent Contractor Agreement, PDF

Recomendado para você

-

The United Nations World Water Development Report 202331 março 2025

-

Made in Abyss Chapter 62.5 & 63: Cravali / The Curse Fleet. : r/MadeInAbyss31 março 2025

Made in Abyss Chapter 62.5 & 63: Cravali / The Curse Fleet. : r/MadeInAbyss31 março 2025 -

Toby Keith, Willie Nelson, Jason Aldean & Country 'Lynching' Songs - Saving Country Music31 março 2025

Toby Keith, Willie Nelson, Jason Aldean & Country 'Lynching' Songs - Saving Country Music31 março 2025 -

:max_bytes(150000):strip_icc()/middle-class.asp-Final-dd68971263234dedb20170928f334461.png) Middle Class: Definition and Characteristics31 março 2025

Middle Class: Definition and Characteristics31 março 2025 -

Ptolemaic Dynasty - World History Encyclopedia31 março 2025

Ptolemaic Dynasty - World History Encyclopedia31 março 2025 -

Regular Figures, Minimal Transitivity, and Reticular Chemistry - Liu - 2018 - Israel Journal of Chemistry - Wiley Online Library31 março 2025

Regular Figures, Minimal Transitivity, and Reticular Chemistry - Liu - 2018 - Israel Journal of Chemistry - Wiley Online Library31 março 2025 -

Woe Is I: The Grammarphobe's Guide by O'Conner, Patricia T.31 março 2025

Woe Is I: The Grammarphobe's Guide by O'Conner, Patricia T.31 março 2025 -

Florence - Wikipedia31 março 2025

Florence - Wikipedia31 março 2025 -

Effectiveness of a community-based approach for the investigation and management of children with household tuberculosis contact in Cameroon and Uganda: a cluster-randomised trial - The Lancet Global Health31 março 2025

Effectiveness of a community-based approach for the investigation and management of children with household tuberculosis contact in Cameroon and Uganda: a cluster-randomised trial - The Lancet Global Health31 março 2025 -

Finland - Wikipedia31 março 2025

você pode gostar

-

Doutor Estranho será novo mentor de Peter Parker em 'Homem-Aranha31 março 2025

Doutor Estranho será novo mentor de Peter Parker em 'Homem-Aranha31 março 2025 -

STRANGER THINGS NO ROBLOX - Brancoala Games31 março 2025

STRANGER THINGS NO ROBLOX - Brancoala Games31 março 2025 -

Blundering on the Brink”: Cuban Missile Crisis Documents from the31 março 2025

Blundering on the Brink”: Cuban Missile Crisis Documents from the31 março 2025 -

March, 201531 março 2025

March, 201531 março 2025 -

Agatsuma, Project Slayers Wiki31 março 2025

Agatsuma, Project Slayers Wiki31 março 2025 -

CABALLEROS DEL ZODIACO Alma de oro CAPITULO 2 ( ¡El secreto de Yggdrasil al descubierto!) - Vídeo Dailymotion31 março 2025

-

Guys, will release of warzone mobile affect cod mobile? Will they31 março 2025

Guys, will release of warzone mobile affect cod mobile? Will they31 março 2025 -

Desafio Da Vitória 3D Do Jogo De Xadrez Ilustração Stock31 março 2025

Desafio Da Vitória 3D Do Jogo De Xadrez Ilustração Stock31 março 2025 -

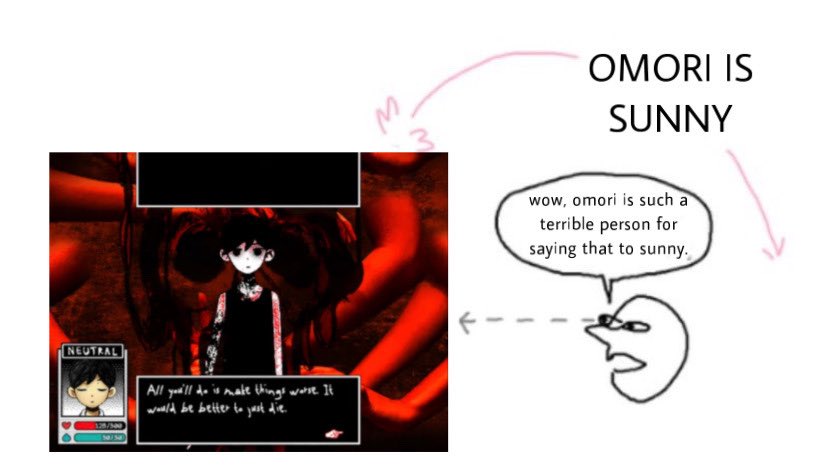

Kaun 🔪🩸 (more active elsewhere) on X: Went to look at the Omori31 março 2025

Kaun 🔪🩸 (more active elsewhere) on X: Went to look at the Omori31 março 2025 -

Lassie House31 março 2025