DoorDash Tax Deductions, Maximize Take Home Income

Por um escritor misterioso

Last updated 07 abril 2025

This article is the ultimate guide for DoorDash tax deductions. Click to read and learn what DoorDashers can write off.

6 Deductions for Avoiding Doordash Driver Taxes

Delivery Driver Expenses 2024: Does DoorDash Pay For Gas?

Doordash Taxes Made Easy, Ultimate Dasher's Guide, Ageras

Common Tax Deductions To Plan For in 2022

DoorDash or Uber Taxes 1099 NEC What you need to know!

How Much Should I Save for Doordash Taxes?

Doordash Is Considered Self-Employment. Here's How to Do Taxes

Tax Deductions for Rideshare (Uber and Lyft) Drivers and Food

40$ per hour they said : r/doordash

6 Deductions for Avoiding Doordash Driver Taxes

Your tax refund could be smaller than last year. Here's why

Recomendado para você

-

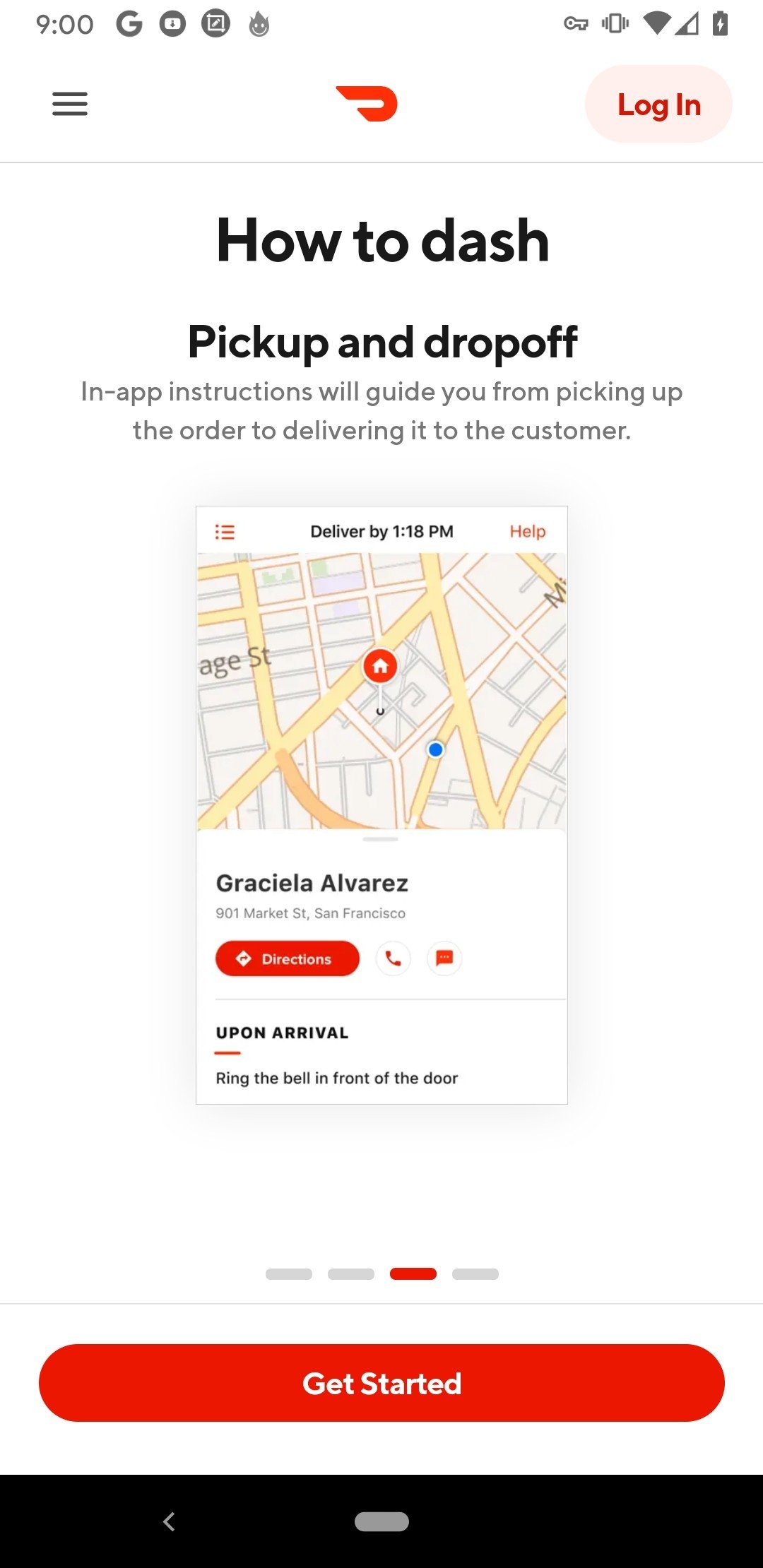

DoorDash - Dasher - Apps on Google Play07 abril 2025

-

DoorDash Drive Portal07 abril 2025

-

DoorDash Driver APK Download for Android Free07 abril 2025

DoorDash Driver APK Download for Android Free07 abril 2025 -

DoorDash 101: Getting Started and Making Money as a Dasher07 abril 2025

DoorDash 101: Getting Started and Making Money as a Dasher07 abril 2025 -

Download DoorDash - Driver on PC with MEmu07 abril 2025

Download DoorDash - Driver on PC with MEmu07 abril 2025 -

TikToker Accuses DoorDash Driver of Stealing Her $100 Food Order07 abril 2025

TikToker Accuses DoorDash Driver of Stealing Her $100 Food Order07 abril 2025 -

DoorDash driver takes bite out of customer's burrito after cheap tip07 abril 2025

DoorDash driver takes bite out of customer's burrito after cheap tip07 abril 2025 -

Best Car Insurance For DoorDash Drivers For 202307 abril 2025

Best Car Insurance For DoorDash Drivers For 202307 abril 2025 -

Your DoorDash driver? He's the company's co-founder - The Columbian07 abril 2025

Your DoorDash driver? He's the company's co-founder - The Columbian07 abril 2025 -

Tip your driver or pay the price: DoorDash warns delivery delays07 abril 2025

Tip your driver or pay the price: DoorDash warns delivery delays07 abril 2025

você pode gostar

-

Metal: Hellsinger - Essential Hits Edition (2023)07 abril 2025

Metal: Hellsinger - Essential Hits Edition (2023)07 abril 2025 -

Ping Pong Fury Table Foldable Regulation Size Tennis Table with Paddle Set07 abril 2025

Ping Pong Fury Table Foldable Regulation Size Tennis Table with Paddle Set07 abril 2025 -

Element Hunters - Pictures07 abril 2025

Element Hunters - Pictures07 abril 2025 -

Star Wars: The Last Jedi earns $450m in opening weekend07 abril 2025

Star Wars: The Last Jedi earns $450m in opening weekend07 abril 2025 -

2022) ALL *NEW* SECRET OP CODES In Roblox Demon Slayer Tower Defense Simulator Codes!07 abril 2025

2022) ALL *NEW* SECRET OP CODES In Roblox Demon Slayer Tower Defense Simulator Codes!07 abril 2025 -

The Daily Life Of The Immortal King temporada 2 capitulo 207 abril 2025

-

Brinquedo Dinossauro T-Rex Para Colorir Didático - Miketa - Kit de Colorir - Magazine Luiza07 abril 2025

Brinquedo Dinossauro T-Rex Para Colorir Didático - Miketa - Kit de Colorir - Magazine Luiza07 abril 2025 -

Eastern hognose snake - Wikipedia07 abril 2025

Eastern hognose snake - Wikipedia07 abril 2025 -

Tonalizante L'Oreal Paris Richesse 9 Louro Muito Claro07 abril 2025

Tonalizante L'Oreal Paris Richesse 9 Louro Muito Claro07 abril 2025 -

🚫NSFW🚫, Wiki07 abril 2025

🚫NSFW🚫, Wiki07 abril 2025