FICA Tax in 2022-2023: What Small Businesses Need to Know

Por um escritor misterioso

Last updated 04 abril 2025

FICA taxes are paid by all workers. The FICA taxes are paid based on your total income from all sources. Here is what small businesses need to know.

Employers: The Social Security Wage Base is Increasing in 2022 - BGM

2024 State Business Tax Climate Index

:max_bytes(150000):strip_icc()/understanding-form-w-2-wage-and-tax-statement-3193059-v4-5bc643e646e0fb0026d3aafc-5c0ab974c9e77c000168e8d4-aa8231daf99c4a29b2eea9e58e5fdca8.png)

What Is Form W-2?

FICA Tax & Who Pays It

LLC Tax Rates and Rules - SmartAsset

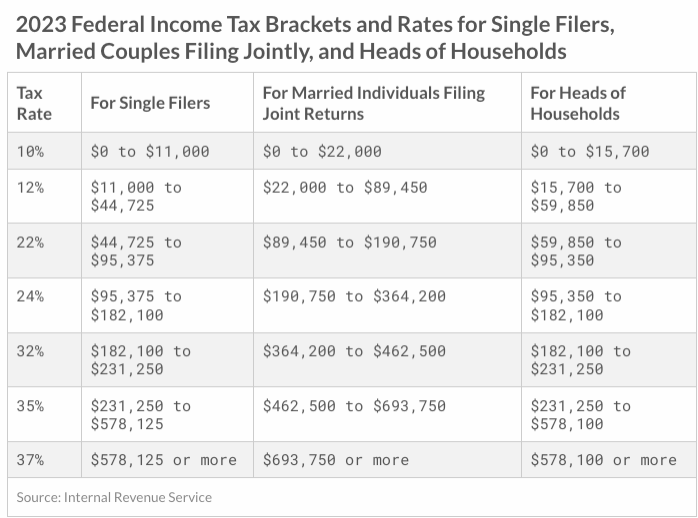

2023 Tax Brackets, Social Security Benefits Increase, and Other

What are FICA Taxes? 2022-2023 Rates and Instructions

:max_bytes(150000):strip_icc()/social_security_card-157422696-5c607e6046e0fb00014422ac.jpg)

Social Security Maximum Taxable Earnings 2022

Do Social Security Recipients Need to File a Tax Return? - CNET

Business Taxes: Annual v. Quarterly Filing for Small Businesses

2023 Tax Deadlines You Need to Know - Experian

Recomendado para você

-

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About FICA, Social Security, and Medicare Taxes04 abril 2025

Learn About FICA, Social Security, and Medicare Taxes04 abril 2025 -

What is FICA tax?04 abril 2025

What is FICA tax?04 abril 2025 -

What is the FICA Tax and How Does It Work? - Ramsey04 abril 2025

What is the FICA Tax and How Does It Work? - Ramsey04 abril 2025 -

What are FICA Tax Payable? – SuperfastCPA CPA Review04 abril 2025

What are FICA Tax Payable? – SuperfastCPA CPA Review04 abril 2025 -

What is the FICA Tax Refund?04 abril 2025

What is the FICA Tax Refund?04 abril 2025 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student04 abril 2025

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student04 abril 2025 -

What it means: COVID-19 Deferral of Employee FICA Tax04 abril 2025

What it means: COVID-19 Deferral of Employee FICA Tax04 abril 2025 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.04 abril 2025

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.04 abril 2025 -

IRS Form 843 - Request a Refund of FICA Taxes04 abril 2025

IRS Form 843 - Request a Refund of FICA Taxes04 abril 2025 -

2019 US Tax Season in Numbers for Sprintax Customers04 abril 2025

2019 US Tax Season in Numbers for Sprintax Customers04 abril 2025

você pode gostar

-

Barbie DreamHouse Dollhouse with 75+ Accessories and Wheelchair Accessible Elevator, 10 Play Areas, 3 Custom Light Settings & Music ( Exclusive) : Toys & Games04 abril 2025

Barbie DreamHouse Dollhouse with 75+ Accessories and Wheelchair Accessible Elevator, 10 Play Areas, 3 Custom Light Settings & Music ( Exclusive) : Toys & Games04 abril 2025 -

The Office Five Nights - Five Nights At Freddy's Withered Freddy Transparent PNG - 420x492 - Free Download on NicePNG04 abril 2025

The Office Five Nights - Five Nights At Freddy's Withered Freddy Transparent PNG - 420x492 - Free Download on NicePNG04 abril 2025 -

FLOOR PLANS - BREAL04 abril 2025

FLOOR PLANS - BREAL04 abril 2025 -

SPIDER-MAN WEB OF Shadows PC GAME DVD - USED - WITH MANUAL - GOOD04 abril 2025

SPIDER-MAN WEB OF Shadows PC GAME DVD - USED - WITH MANUAL - GOOD04 abril 2025 -

Hajime no Ippo Capítulo 1333 - Manga Online04 abril 2025

Hajime no Ippo Capítulo 1333 - Manga Online04 abril 2025 -

Mister X (Vortex) - Wikipedia04 abril 2025

Mister X (Vortex) - Wikipedia04 abril 2025 -

God of War (jogo eletrônico de 2005) – Wikipédia, a enciclopédia livre04 abril 2025

God of War (jogo eletrônico de 2005) – Wikipédia, a enciclopédia livre04 abril 2025 -

Tanjiro #Inosuke #Zenitsu #KimetsuNoYaiba04 abril 2025

Tanjiro #Inosuke #Zenitsu #KimetsuNoYaiba04 abril 2025 -

Feel (Studio) - Zerochan Anime Image Board04 abril 2025

Feel (Studio) - Zerochan Anime Image Board04 abril 2025 -

![Sonic & Knuckles (Music) [Sega Genesis / Mega Drive] : Free](https://archive.org/services/img/md_music_sonic_knuckles/full/pct:500/0/default.jpg) Sonic & Knuckles (Music) [Sega Genesis / Mega Drive] : Free04 abril 2025

Sonic & Knuckles (Music) [Sega Genesis / Mega Drive] : Free04 abril 2025