2021 FICA Tax Rates

Por um escritor misterioso

Last updated 17 abril 2025

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

FICA tax rate 2022: How can you adjust you Social Security and Medicare taxes?

Social Security Administration Announces 2022 Payroll Tax Increase

Payroll Tax Rates (2023 Guide) – Forbes Advisor

What Is Medicare Tax? Definitions, Rates and Calculations - ValuePenguin

Withholding FICA Tax on Nonresident employees and Foreign Workers

Payroll Tax Rates and Contribution Limits for 2022

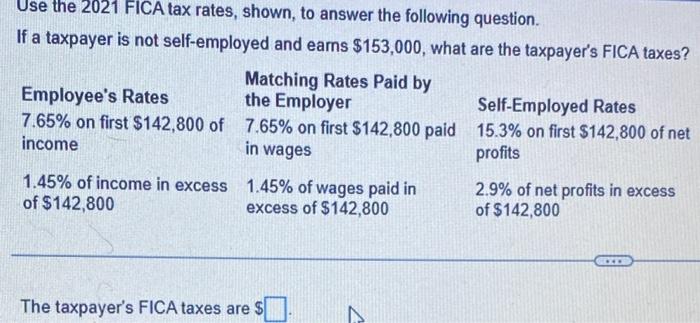

Solved Use the 2021 FICA tax rates, shown, to answer the

FICA Tax: What It is and How to Calculate It

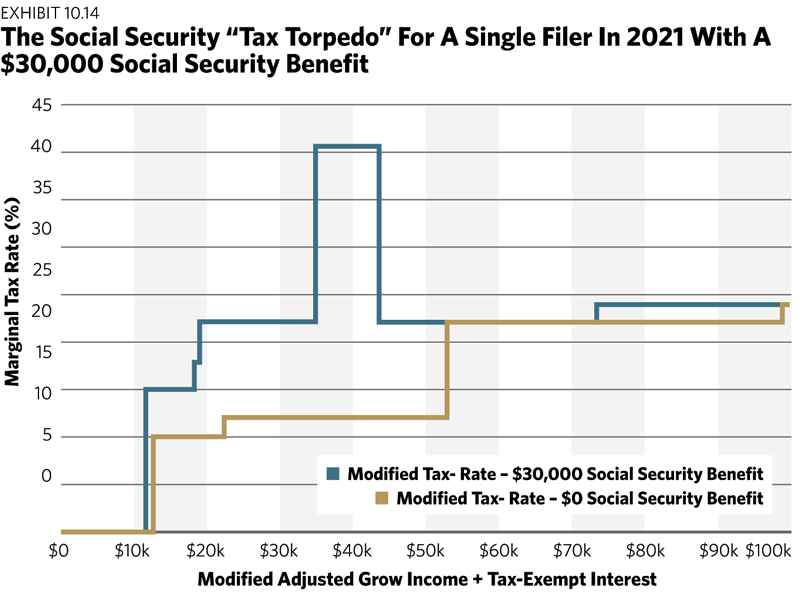

Avoiding The Social Security Tax Torpedo

FICA Tax: What It is and How to Calculate It

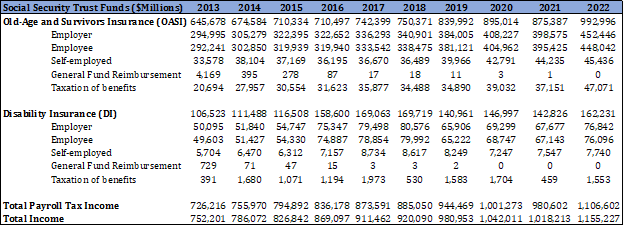

Social Security Financing: From FICA to the Trust Funds - AAF

What is the FICA Tax? - 2023 - Robinhood

Understanding Medicare Tax

Recomendado para você

-

FICA Tax: What It is and How to Calculate It17 abril 2025

-

FICA Tax: 4 Steps to Calculating FICA Tax in 202317 abril 2025

FICA Tax: 4 Steps to Calculating FICA Tax in 202317 abril 2025 -

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers17 abril 2025

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers17 abril 2025 -

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)17 abril 2025

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)17 abril 2025 -

FICA Refund: How to claim it on your 1040 Tax Return?17 abril 2025

FICA Refund: How to claim it on your 1040 Tax Return?17 abril 2025 -

What is the FICA Tax? - 2023 - Robinhood17 abril 2025

-

FICA Tax in 2022-2023: What Small Businesses Need to Know17 abril 2025

FICA Tax in 2022-2023: What Small Businesses Need to Know17 abril 2025 -

What is the FICA Tax Refund? - Boundless17 abril 2025

What is the FICA Tax Refund? - Boundless17 abril 2025 -

What it means: COVID-19 Deferral of Employee FICA Tax17 abril 2025

What it means: COVID-19 Deferral of Employee FICA Tax17 abril 2025 -

2017 FICA Tax: What You Need to Know17 abril 2025

2017 FICA Tax: What You Need to Know17 abril 2025

você pode gostar

-

Satsuriku no Tenshi (Angels of Death)17 abril 2025

Satsuriku no Tenshi (Angels of Death)17 abril 2025 -

SPOHR on X: Cor nova :) Majirel 6.34+7.4 ox20/ base igora 6.77 ox20 bem desbotada. (45 dias) / X17 abril 2025

SPOHR on X: Cor nova :) Majirel 6.34+7.4 ox20/ base igora 6.77 ox20 bem desbotada. (45 dias) / X17 abril 2025 -

Minecraft: The Living Storm: The Wither Storm by Indominimus231517 abril 2025

Minecraft: The Living Storm: The Wither Storm by Indominimus231517 abril 2025 -

Ícones de xadrez em SVG, PNG, AI para baixar.17 abril 2025

Ícones de xadrez em SVG, PNG, AI para baixar.17 abril 2025 -

gramática17 abril 2025

-

Miami Beach Florida Summer Time T-Shirt : Clothing17 abril 2025

Miami Beach Florida Summer Time T-Shirt : Clothing17 abril 2025 -

Kawaii kitten coloring pages17 abril 2025

Kawaii kitten coloring pages17 abril 2025 -

Lista de jogadores convocados para a Seleção Brasileira nos Jogos17 abril 2025

Lista de jogadores convocados para a Seleção Brasileira nos Jogos17 abril 2025 -

Emoji - Royalty-Free GIFs - Animated Clipart - Cliply17 abril 2025

Emoji - Royalty-Free GIFs - Animated Clipart - Cliply17 abril 2025 -

callipygous17 abril 2025