Tier 1 Capital Ratio: Definition and Formula for Calculation

Por um escritor misterioso

Last updated 31 março 2025

:max_bytes(150000):strip_icc()/Tier_1_Capital_Ratio_final_v3-057aabaee3b247228bde4b73c66ae9de.png)

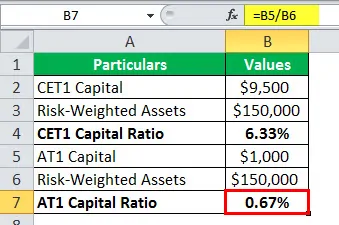

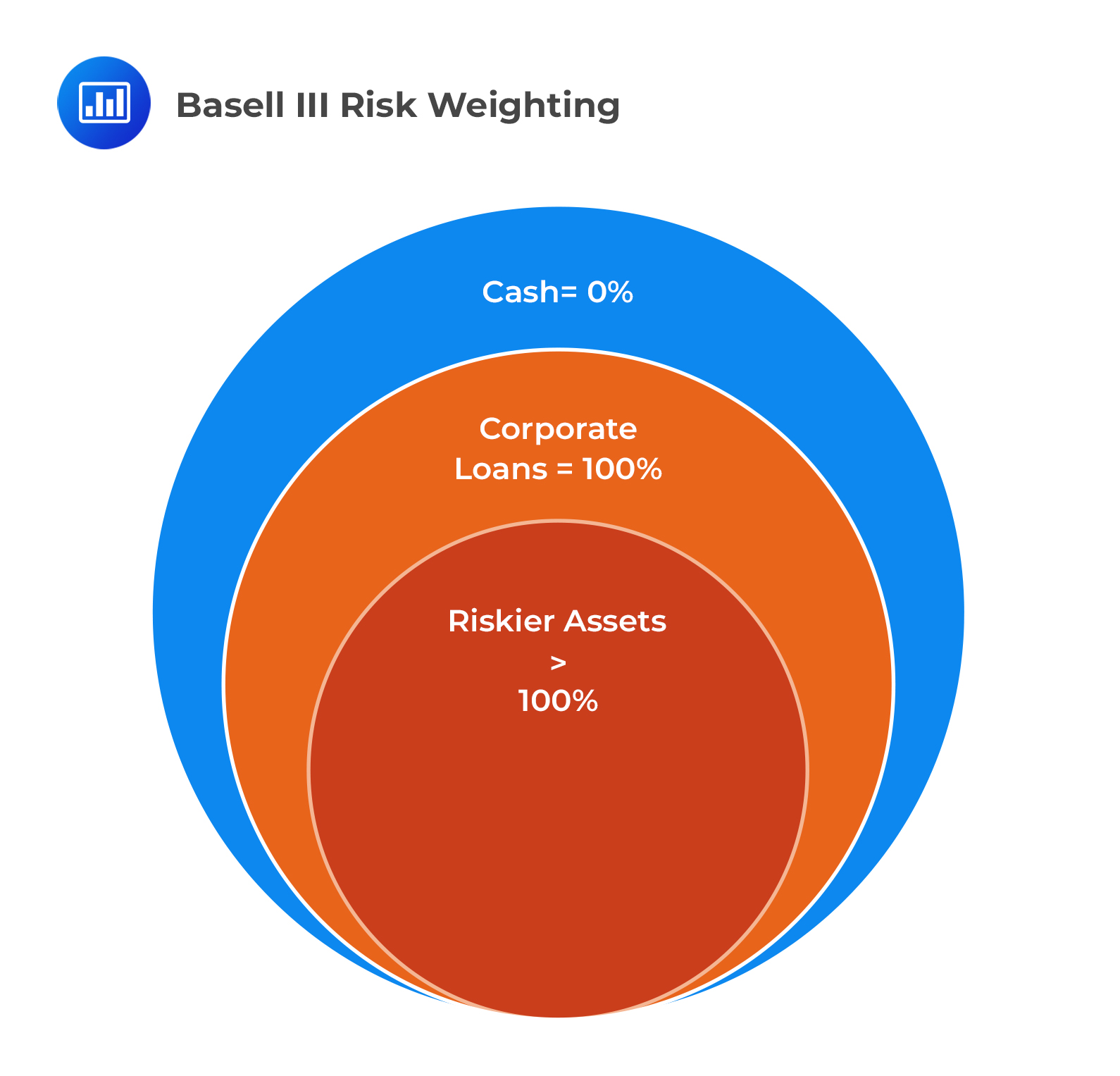

The tier 1 capital ratio is the ratio of a bank’s core tier 1 capital—its equity capital and disclosed reserves—to its total risk-weighted assets.

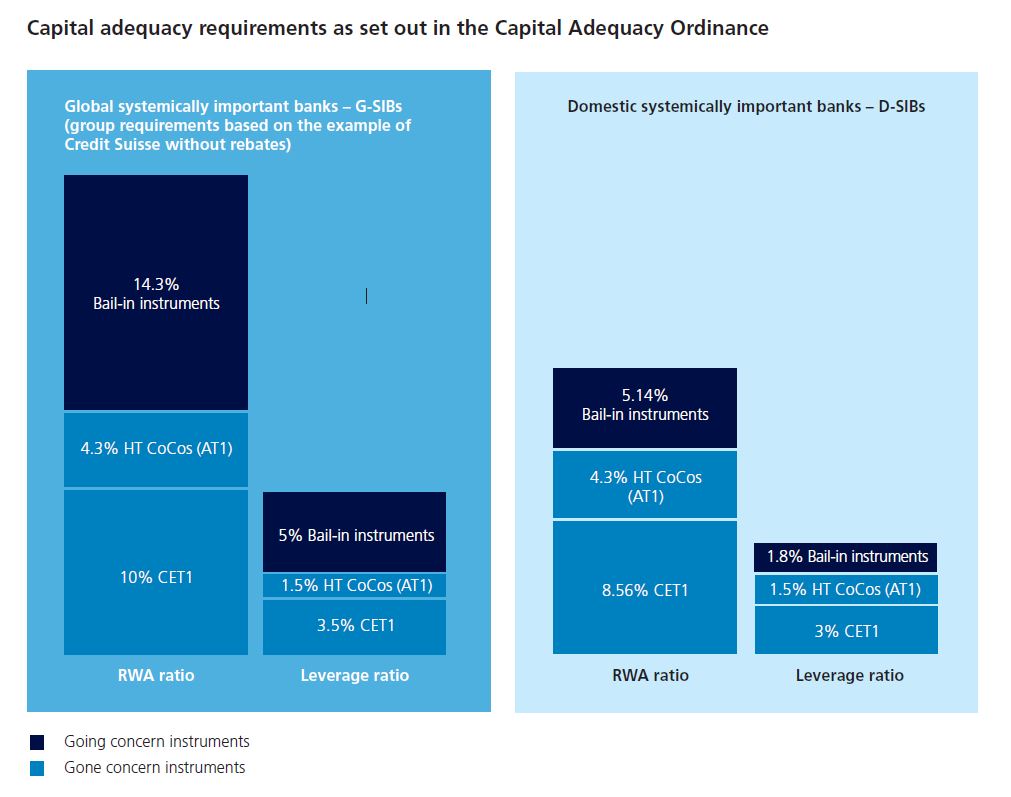

Capital requirements for systemically important banks

:max_bytes(150000):strip_icc()/tier1capital.asp_FINAL-9183cdc7ec8b4bd2b230d4ee7af1dec6.png)

Tier 1 Capital: Definition, Components, Ratio, and How It's Used

Capital Adequacy Ratio (CAR) - Overview and Example

:max_bytes(150000):strip_icc()/Common-equity-tier-1-cet1_final-cb6afdb761574a8f867c846f81bc5de4.png)

Common Equity Tier 1 (CET1) Definition and Calculation

Liquidity Ratio – Types, Formula, Interpretation, How to Improve it - Shiksha Online

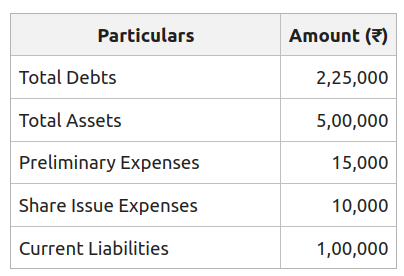

Total Assets to Debt Ratio: Meaning, Formula and Examples - GeeksforGeeks

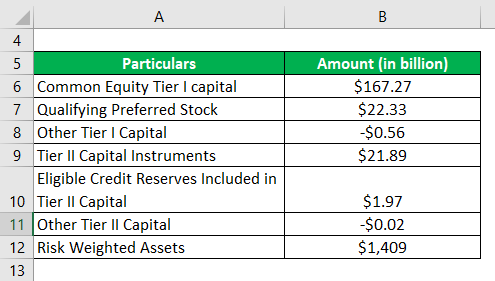

Tier 1 Capital Ratio (Definition, Formula)

Capital adequacy ratio: definition, formula, importance

Capital Adequacy Ratio Step by Step calculation of CAR with Advantages

The CAMELS Approach - CFA, FRM, and Actuarial Exams Study Notes

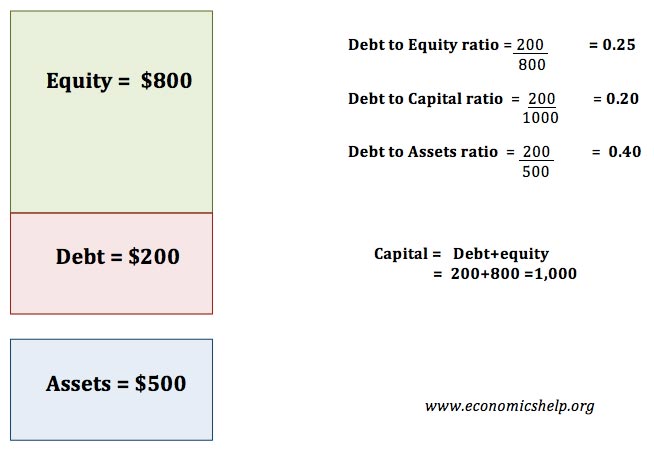

Leverage ratio - Economics Help

Leverage Ratios - Debt/Equity, Debt/Capital, Debt/EBITDA, Examples

Recomendado para você

-

Zodiac Signs In The Tier List - 6 Top Tier Zodiac Signs31 março 2025

Zodiac Signs In The Tier List - 6 Top Tier Zodiac Signs31 março 2025 -

Pin by Soljurni on Randomness Everyday quotes, Daily inspiration31 março 2025

Pin by Soljurni on Randomness Everyday quotes, Daily inspiration31 março 2025 -

S-tier - What does S-tier mean?31 março 2025

S-tier - What does S-tier mean?31 março 2025 -

Astrologer Weighs In On Viral TikTok Astrology Zodiac Sign Ranking31 março 2025

Astrologer Weighs In On Viral TikTok Astrology Zodiac Sign Ranking31 março 2025 -

:max_bytes(150000):strip_icc()/tier1capital.asp_FINAL-9183cdc7ec8b4bd2b230d4ee7af1dec6.png) Tier 1 Capital: Definition, Components, Ratio, and How It's Used31 março 2025

Tier 1 Capital: Definition, Components, Ratio, and How It's Used31 março 2025 -

God Tier: Mathematics / Physics / Chemistry / Astronomy31 março 2025

God Tier: Mathematics / Physics / Chemistry / Astronomy31 março 2025 -

Top Tier Marketing Academy on Big Data Analytics: Unlocking31 março 2025

Top Tier Marketing Academy on Big Data Analytics: Unlocking31 março 2025 -

Busted open - Iva Cheung31 março 2025

Busted open - Iva Cheung31 março 2025 -

Tier list meaning: How fighting games kicked off a bizarre31 março 2025

Tier list meaning: How fighting games kicked off a bizarre31 março 2025 -

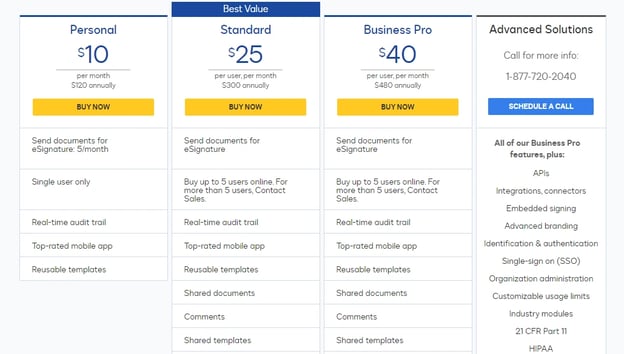

Tiered Pricing: The Complete Guide31 março 2025

Tiered Pricing: The Complete Guide31 março 2025

você pode gostar

-

Gangue Loca: a lost Media dos servidores do discord : r/GangueLouca31 março 2025

Gangue Loca: a lost Media dos servidores do discord : r/GangueLouca31 março 2025 -

Assassin's Creed Valhalla: Complete Edition31 março 2025

Assassin's Creed Valhalla: Complete Edition31 março 2025 -

PlayStation Shares More Details on Horizon Forbidden West's Burning Shores : Seasoned Gaming31 março 2025

PlayStation Shares More Details on Horizon Forbidden West's Burning Shores : Seasoned Gaming31 março 2025 -

Critical Role Ashley Johnson GIF - Critical Role Ashley Johnson31 março 2025

Critical Role Ashley Johnson GIF - Critical Role Ashley Johnson31 março 2025 -

Uga Buga!: : Everything Else31 março 2025

Uga Buga!: : Everything Else31 março 2025 -

Presidente Filipe Nyusi - Excelência e Caro Irmão. Tendo estado a31 março 2025

-

HIGURASHI NO NAKU KORO NI SOTSU Ltd DVD w/Figure CD Book NEW Rare31 março 2025

HIGURASHI NO NAKU KORO NI SOTSU Ltd DVD w/Figure CD Book NEW Rare31 março 2025 -

Otadesu Updates - A dublagem em português do anime Summer Time Rendering já está disponível no catálogo estrangeiro da Disney+. Em breve o anime também deve chegar ao Brasil. A versão brasileira31 março 2025

-

/cdn.vox-cdn.com/uploads/chorus_image/image/55599867/trial_of_the_sword_header.0.jpg) Zelda Breath of the Wild guide: Trial of the Sword: Beginning31 março 2025

Zelda Breath of the Wild guide: Trial of the Sword: Beginning31 março 2025 -

Fidelis Care CareValue Insurance Marketing31 março 2025

Fidelis Care CareValue Insurance Marketing31 março 2025